Posting of PPF/SSA Intersol deposits by PM at HO in DOP Finacle

Implementation of 25,000 intersol limit in DOP Finacle

- Cheques accepted for subsequent deposits in Sub Office PPF / SSA accounts are lodged at HO in 0017 account of HO and posting is carried out at HOs after clearance, to facilitate posting, as per SB order 5 of 2016 intersol limit has been configured as 1.5 lakhs on 07/01/2017 as a temporary solution.

- In order to settle the above issue new patch deployed in DOP Finacle for intersol transactions

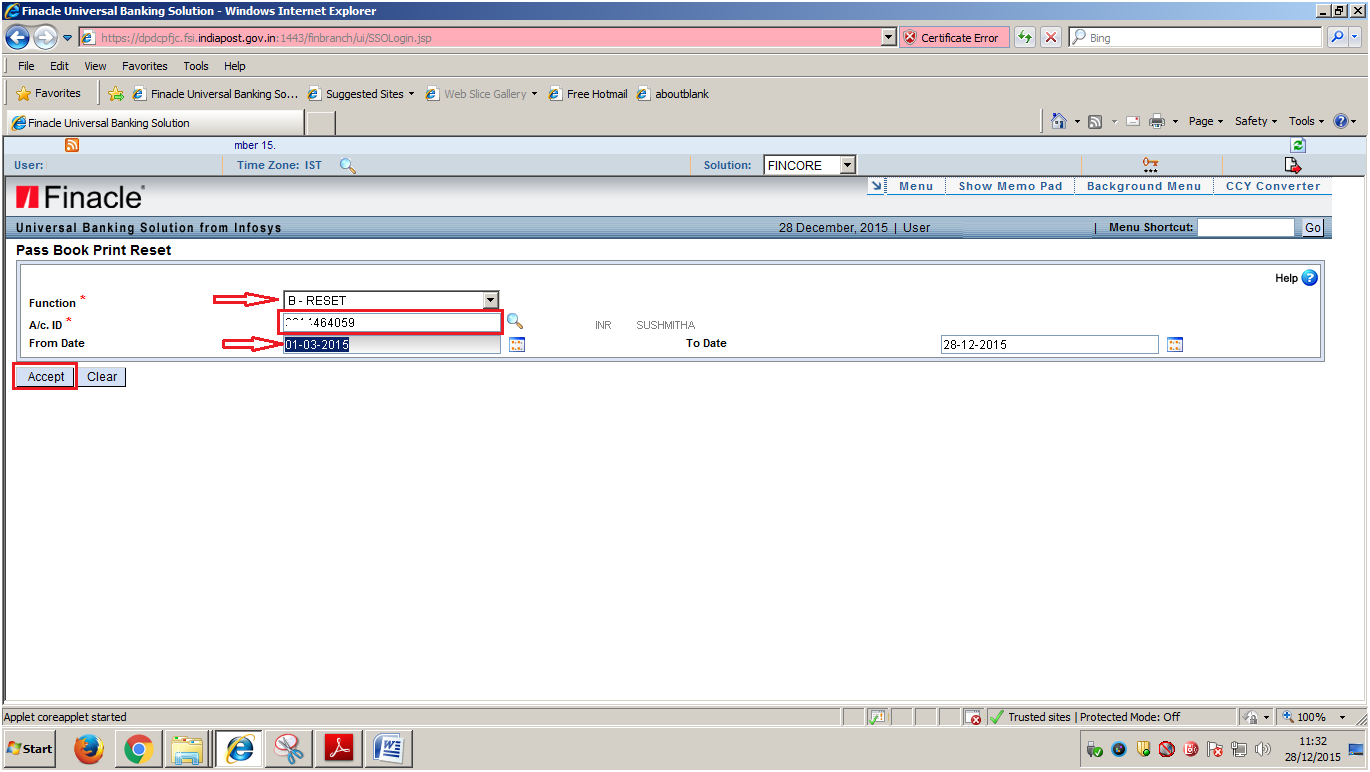

- All PO's are instructed to follow the below procedure for posting high value PPF/SSA deposits

- Postmaster role users at HO are given access to CPDTM/CPWTM menus (for PPF/SSA accounts) for posting the subsequent deposits through cheques of sub offices.

- The high value deposits for PPF/SSA will be done by Postmaster instead of PA handling Cheque clearance.

- Please revert immediately in case of any issues.