A complete Guide for DOP Finacle, McCamish, CSI, RICT & IPPB

Articles by "SB Orders"

15G

15H

7th CPC

Aadhaar

Aadhaar Fees

Aadhaar Operations

Aadhaar Software

Aadhaar Survey

AAO

ABVKY

Account

Account Opening Form

Accountant Exam Books

Accountants

Accounts Officers

Active Directory

AD login

AD Rollout

Adhoc Norms

Agent Creation

Agent Portal

Agents

Air Tickes

Allowance

Android App

APAR

APS Accounts

APY

Arrears

ATM

ATM Cash Loading

ATM Form

Audit Para

AV Rollout

Bank Reconciliation

Bank Transfer

Biometric Device

Black Money

Blocking Validations

BNPL

BO

BO Device

BO Rules

BO Slip

BO Slip Generator

BO Transactions

Bonus

BOOKS

BPC

BPM

BPM Arrears Table

BPM Transfer

Branch Office

Browser Settings

Budget

Bulk

Bulk Booking

Bulk Closure

Bulk Upload

Bulk Upload File Creator

Business

Business Hours

Business Parcel

Cadre Restructuring

Calculator

Cash & Bank

Cash Handling Allowance

Cash Management

Casual Labour

CBS

CBS Commands

CBS FAQ

CBS-CSI

CCS Rules

CEA

Central Government Employees

Central Vigilance Commission

Certificate Printing

CGEGIS

CGHS

Check List

Cheque

Cheque Book

Cheque Lot Creation

Cheque Request

Cheques Clearing

Child Card Leave

Children Education Allowance

Circulars & Orders

CIS

Claim Settlement

Clarification

Close Account

Closure

COD

Compare and Book

Configuration

Contract Creation

Court News

CPAO Orders

Creation of CIF

CRM Portal

CSD

CSI

CSI Daily Work Flow

CSI Hand Book for RMS

CSI Helper Tool

CSI Master Guide

CSI Templates

CSI Tool

CSI Tools

CSI Training Manual

CSI Updates

CSI Utility Tool

CSV File Generator

CSV Uploading

Currency Ban

Currency Exchange

Customer Creation

Customer Portal

DA

DA Freeze

DA News

DA Orders

DARPAN

Dearness Allowance

Dearness Relief

Death Claim

Default Fee

Demonetization

Department Exams

Department of Expenditure

Department of Posts

Departmental Examination

Desktop Configuration

Desktop Settings

Despatch

Despatch Schedule

DEST

Digital India

Digital Life Certificate

Digital Payment

Directorate

Directorate Appeal

Directorate Order

Disbursement

Discrepancies

Document Reversal

DOP

DOP Core Solutions

DOP CSI Hand Book

DOP Finacle Guide

DOP IFSC Code

DOP Internet Banking

DOP Mobile Banking

DOP News

DOP Orders

DOP Rulings

DoPT

DoPT Order

DoT

DPMS

Drivers

DSA

Dte Orders

Duplicate

e-Banking Form

e-Commerce

e-Commerce Portal

e-Services

Earned Leave

ECB Memo

ECMS

ECMS Settings

Emergency Leave

eMO

eMO Workflow

EMOs

EMOs Procedure

Employee Online

Employee Portal

Employee Transfer

Employment News

End User

Enumeration

EO App

EOD

ePay Billers

ePayment

ePost

Epson

Errors & Solutions

ESS

Establishment Register

EWS Reservation

Express Parcel

Extension

External Antenna

F&A

Family Pension

FAQ

Finacle

Finacle Guide

Finacle Guide Book

Finacle Updates

Financial Powers

First Day on Finacle

Five Day Week

Fixed Stationary Charges

Flow Chart

Fmenu

Form 60

Forms

Forms & Documents

Franchised Outlet

FRSR

FSC

Gazette Notification

GDS

GDS Committee Report

GDS New Pay Table

GDS Transfer Policy

GEM

General

General Financial Rules

General Ledger Sub Head Code

General News

GL Accounts

GL Codes

GL Integration

Govt Orders

GPF

Gratuity

GST

Guide Lines

Guidelines

HBA Rules

HFINRPT

Hindi

HO

Honorarium

House Building Advance

HR

HR Solutions

HRA

Identity Card Form

iMO

Incentive

Incentive Structure

Income Tax

Income Tax Saving

Increment

India Post

India Post Mail

India Post Toll Free

Info Type

Inspector of Posts

Install Mantra Device

Installation

Inter SOL

Interest Calculator Lite

Interest Rates

Interest Rates Data

Interest Statement

International Mail

International Parcel

Internet Banking

Internet Explorer Settings

Inventory

Inventory Management

Inventory Movement

Inventory Status Report

Inward Clearing

Inward Rejection

IP

IP Exam Syllabus

IP&ASP

IPO Indent

IPOs

IPPB

IPPB CBS MENUS

IPPB FAQ

IPPB Finacle Menus

Issue

Issue Cheque

Issue Cheque Book

Issue Duplicate Certificates

Jan Suraksha

Java

Jeevan Pramaan

Judgement

KVP

KYC

LDCE

Leave

Leave Management

Leave Rules

Ledger Inquiry

Legacy Document Upload

Letter to Dte

LGO Exam

Liability Document

Life Certificate

Lipi Passbook Printer

List Of Balance

List of Holidays

List of Office Accounts

List of Run Commands

Live Account Report

Loan

Loan Account

Loan Account Opening

Loan Repayment

LTC

MACP

Mail Booking

Mail Guard

Mail Operations

Marketing

Marketing Executives

Mass Official Transfer

Material

Material Balance

Maternity Leave

Maturity Calculation

McCamish

MCD

MDM

Meghdoot

Menu List

Merchant Mobile App

MGNREGA

Micro ATM

Ministry of Finance

MIS

MIS Server

Mobile Banking

Mobile Banking Form

Mobile Charges

Mobile Number

Mobile Wallet

MPKBY

MTS

Name Change

National Pension System

New Pension Scheme

New Policy Bond Formats

New Services

NJCA

NJCA Meeting

Nominal Role

Nominee

NPS

NSC

NSS

Objections

Official Transfer

Offline Update

Online

Online Payment

Online Registration

Online Training

Open Account

Operations Guide

OSL

OT

Outsource Agents

Outstation Cheques

Outward Cheque Status

Outward Clearing

Outward Rejection

Overview

Ownership Change

Part Closure

Part Withdrawal

Passbook Printing

Passbook Reprinting

Paternity Leave

Pay & Allowance

Pay Commission

Pay Fixation

Pay Revision

PAYROLL

Payslip

Pension

Pension Upload

Pensioners

Pensioners News

PFRDA

Pincode Tool

Pineapple

PLI

PLI Bonus

PLI Terms

PMJJBY

PMLA

PMSBY

PO Finacle Guide

Point of Sale

POLI Rules

POS

POS Back Office

PoS Machine

POS Server

POSB

Post Office

Post Office IFSC Code

Post Office Operation Guide

Post Office Workflow

Postal Assistants

Postal Exams

Postal Manuals

Postal Savings Schemes

Postman

Postman Examination

Postman Mobile Application

Postmaster Cadre

Postmaster Grade-1

PPF

PPF Deposit

Precautions

Prerequisites

Prevent Frauds

Print Bond Queue

Printer Settings

Printing

Procedure

Promotion

Proposal Forms

Pushback

QR Cards

Questions & Answers

Quick TCB

RBI

RBI Order

RD

RD Deposit

RD Loan

RD Loan Account

RD Services

Ready Reckoner

Receipt Cancellation

Recruitment

Recruitment Rules

Register Letter

Reimbursement

Remuneration Pay

Renewal

Report

Reports

Reservation

Retirement

Reversal

Reversal of Clearing Document

Revised Service Request Forms

Revision of Interest Rates

RFMS Tcodes

RICT

Risk Allowance

Rlist

RMFS

RMS CSI Guide

Rotational Transfers

RPLI

Rule 38

Rules

Rulings

Rural ICT

Salary

Salary Account

Salary Upload

SAP

Saving Schemes

Savings Account

Savings Schemes

SB

SB Deposit

SB Orders

SB Withdrawal

SBCO

SBI Buddy

SCSS

Security Tips

Senior Citizen

Seniority

Service Desk

Service Tax

SETID

Settings

SGB

Short Notes

Shortcut Keys

Simple CSI Assist

SMS Alerts

SMS Banking

SO

SO Slip

SO Slip Generator

Software Configuration

Softwares

SOP

Sorting Assistants

Sovereign Gold Bonds

Speedpost

Speedpost Booking Machine

Split Cheque Book

Sports

SSA

SSC CHSL 2016

Staff Scheduling System

Stamp Balance

Stamp Indent

Stamps

Standing Instruction

Stenographer

Step by Step CSI Guide

Stock

Stop Payment

StopDB

Strike

Study Materials

Super User

Syllabus

Symantec

Sync Issues

System Administrators

T-Codes

Tarrif

Tax Slabs

TCB

TD

TDS

Teller Cash Balance

Tenure

Tools

TPTA

Training Allowance

Training Application

Training Manual

Transfer

Transfer In

Transfer of Accounts

Transfers & Postings

Travelling Allowance

Treasury Allowance

Trial Close

UIDAI

UIDAI Circular

Union

Union News

Updates

UPSC

User Guide

User Manual

Vault Operations

Video

Viewing Documents

Vigilance

VP Articles

VP Intimation

Weblink

Webmail

Welfare

Will

Windows Tips

Withdrawal

Workaround

Workflow

WUMTS

Showing posts with label SB Orders. Show all posts

SB Order 11/2017 : Closing of accounts/ certificates belonging to discontinued schemes including NSS-87 and NSS-92 in Post Office working on CBS platform

SB Order 11/2017 : Closing of accounts/ certificates belonging to discontinued schemes including NSS-87 and NSS-92 in Post Office working on CBS platform

ADDENDUM-II of SB ORDER NO. 14/2015

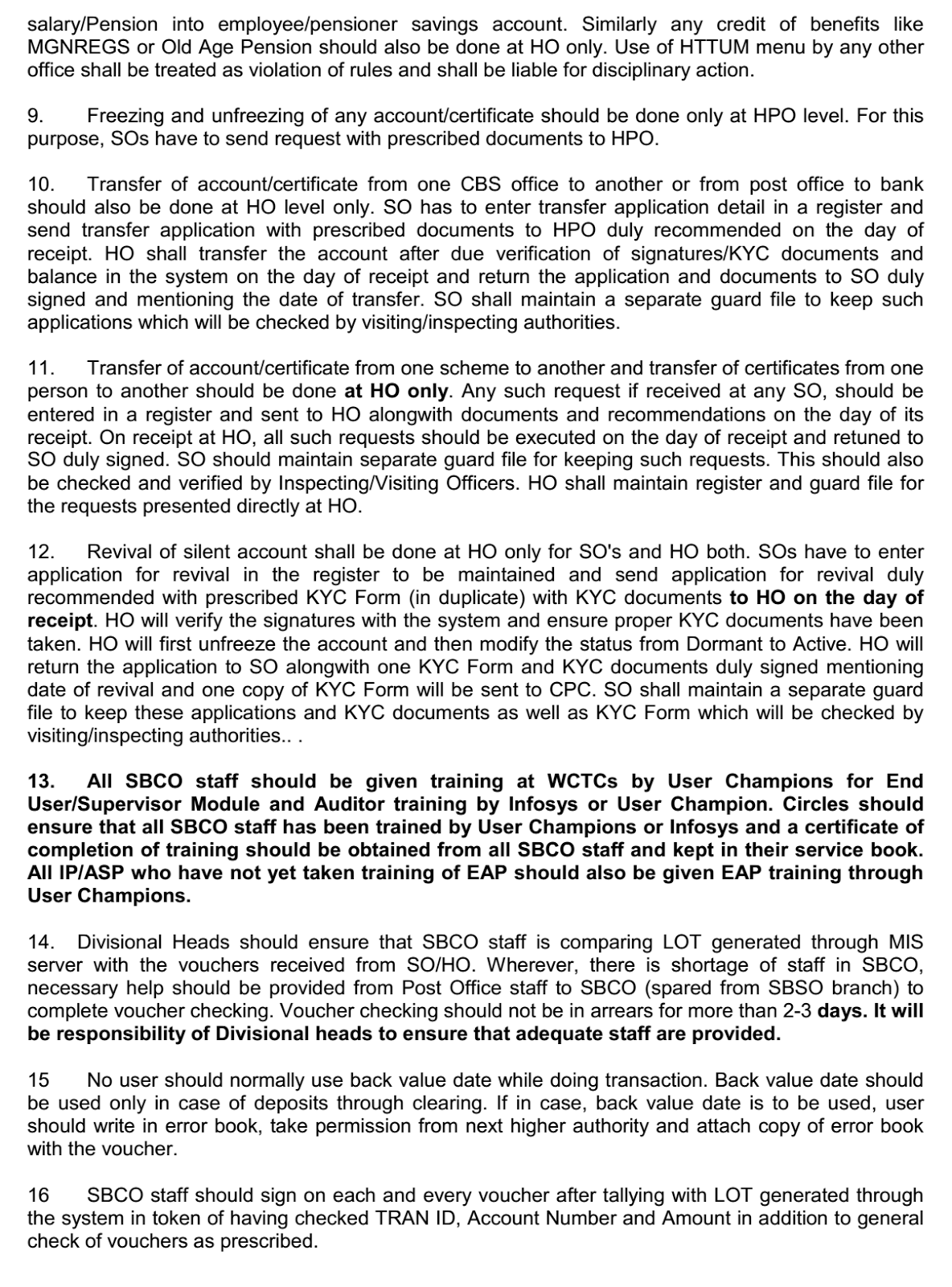

Change of Role of SBCO in the backdrop of implementation of CBS:

ANNEXURE TO SB ORDER 14/2015 ADDENDUM-II

1. General

1.1 As and when SOs are migrated to CBS, staff working in SOSB Branch should be reduced and re-deployed either at POSB Counters or at CPC or in the SBCO Branch for assistance in physical voucher checking.

1.2 Supervisor SBCO will identify one SBCO PA who will take vouchers bundles with consolidation from Sub Account and tally totals shown in consolidation with amount shown in SO Daily Account and SO Summary.

1.3 Handling of Agent Commission Schedules and ACG-17 by SBCO will be discontinued.ACG-17 will be preserved alongwith Agent Commission Report/schedule in the Accounts Branch of HPO and sent to PAO alongwith other schedules.

1.4 In case of RD deposits accepted through MPKBY Agents, only two copies of Agent LOT is to be taken from the agent alongwith pay-in-slip and ACG-17. One copy of Agent LOT will be kept in the office guard file and second copy Agent schedule (LOT) should be attached with the pay-in-slip and placed at the end of RD Voucher Bundle.ACG-17 is to be attached with the Agent Commission Report/schedule and sent to Accounts Branch of HO.

1.5 Account Opening Form (SB-3/AOF) where KYC documents are attached will not be transferred to SBCO alongwith Account Closure Voucher. APM/SPM should record on the closed vouchers that “ SB-3/AOF retained with KYC documents”. In case of any SB-3 or AOF with whom KYC documents are not attached (subsequently opened accounts), SB-3 or AOF is to be attached with the closed voucher and sent to SBCO. SBSO branch of HOs will send all SB-3 of SOs (migrated to CBS) to the respective SOs. In case of Accounts closed at the Post Office other than the one where account was opened, Account Transfer Form collected by the Post Office at the time of closure should be attached with the closure voucher.

1.6 In case of any adjustment if required in interest, Postmaster/Sub Postmaster will write error book and raise the issue to Head Postmaster who will raise the issue with Supervisor SBCO. In case of any adjustment related to pre-migration period, Head Postmaster will raise the issue with Divisional Head with copy of error book who will after necessary inquiry (if required), approve adjustment and send letter to SBCO Supervisor.

1.7 Postmaster/APM/SPM will be held personally responsible for all transactions happened in the Finacle Office Accounts in the post office. They should be vigilant while verifying thetransactions to see the Office Account Number used by the User.

SB Order - 5/2016 Steps to be taken for smooth functioning of POSB operations and prevention of frauds in CBS Offices

The undersigned is directed to refer to this office letter of even number dated 10.5.2016 and 10.6.2016 on the subject vide which various steps to be taken by Post Offices/Divisions/ Circles were circulated to Heads of Circles. Now, the competent authority has decided to circulate these steps in the shape of SB Order. Details of steps to be taken are given below:-

List of SB Orders Released in 2011

- 1/2011 - Subject : Use of prescribed Account Opening Form (Form’A’) while opening PPF accounts to avoid irregular opening of Joint accounts in PPF.

- 2/2011 - Subject : Clarifications regarding new procedure prescribed for settlement of deceased claim cases vide SB Order 25/2010.

- 3/2011 - Subject : Appointment of agents and other agency functions – fresh instructions issued by MOF(DEA) regarding.

- 4/2011 - Subject : Implementation of AML/CFT norms in Small Savings Schemes and Remittances in post offices- carrying out Inspection and its further review regarding.

- 5/2011 - Subject : Appointment of agents and other agency functions- issue of clarifications regarding (Limit of acceptance of cash from SAS agent(Rs-10000/-)

- 6/2011 - Subject : Treating the MSY accounts at par with savings accounts and charging of service charge of Rs.20/- per year.

- 7/2011 - Subject : Extension of PPF Scheme up to Post Offices with sanctioned strength of 2+1 (‘A’ class post office) w.e.f 1.7.2011.

- 8/2011 - Subject : Payment of deposits/certificates belong to minors- a clarification regarding

- 9/2011 - Subject : Treating letter issued by UIDAI for issue of Aadhar Number as valid ID and Address Proof as KYC/CDD document under Anti-Money Laundering (AML)/Combating of Financing of Terrorism (CFT) norms for small savings schemes.

- 10/2011 - Subject : Enhancement of Savings Bank Allowance to Postal Assistants working in SB Branches.

- 11/2011 - Subject : Opening of more than one account in the same scheme in the name of same depositor or acceptance of more than one purchase application of the same scheme in the name of same depositor in one post office on a single day-a clarification regarding.

- 12/2011 - Subject : Acceptance of original document as a proof of death in case of settlement of deceased claim case as per new procedure prescribed vide SB Order 25/2010-a clarification regarding

- 13/2011 - Subject : Admissibility of interest in PPF(HUF) accounts matured between13.5.2005 to 7.12.2010 -a clarification regarding..

- 14/2011 - Subject : Restriction on opening of more than one account in the same scheme in the name of same depositor or acceptance of more than one purchase application of the same scheme in the name of same depositor in one post office on a single day- a further clarification regarding.

- 15/2011 - Subject : Settlement of deceased claim case in respect of Sr. Citizen’s Savings Scheme account- a clarification regarding

- 16/2011 - Subject : Grant of Savings Bank Allowance to Postal Assistants working in Savings Bank/certificate branches- holding of SBAptitude Test regarding

- 17/2011 - Subject : Admissibility of commission to SAS Agents.(on limit of amount of deposit)

- 18/2011 - Subject : Procedure to be followed during voucher checking by SBCO staff-a clarification reg

- 19/2011 - Subject : Implementation of AML/CFT norms in Small Savings Schemes- an external inspection of selected post offices by Min. of Finance Regarding

- 20/2011 - Subject : Removal of ceiling of maximum balance to be retained in a post office savings account- amendment to Rule-4 of the Post Office Savings Account Rules 1981 reg

- 21/2011 - Subject : Attestation of Annexure-II (Affidavit) and Annexure-III (Disclaimer on Affidavit) incase of deceased claim case preferred where there is no nomination

- 22/2011 - Subject : Discontinuation of Kisan Vikas Patras w.e.f 1.12.2011.

- 23/2011 - Subject : Revision of maturity period and maturity value of 6 years National Saving Certification (NSC) VIII with effect issue from 1-12-2011.

- 24/2011 - Subject : Revision of maximum limit of subscription in a financial year, rate of interest on balance in the PPF Account and rate of interest charged on loan taken from PPF account with effect from 1-12-2011.

- 25/2011 - Subject : Revision of maturity period, rate of interest and discontinuation of 5% bonus on maturity of Monthly Income Account scheme with effect from 1-12-2011.

- 26/2011 - Subject : Revision of interest rate on balance at credit fromPost Office Savings Account with effect from 1-12-2011

- 27/2011 - Subject : Revision of rate of interest of Time Deposit Account with effect from 1-12-2011

- 28/2011 - Subject : Revision of rate of interest of Recurring Deposit Accountwith effect from 1-12-2011

- 29/2011 - Subject : Revision of rate of commission payable to SAS and MPKBY agent discontinuance of commission to PPF Agent with effect from 1-12-2011

- 30/2011 - Subject : Introduction of new schemes called “10 Year National Savings Certificate (IX Issue)” with effect from 1-12-2011

- 31/2011 - Subject : Modifications in PORD Rules 1981, Post Office Monthly Income Account Rules 1987, POTD Rules 1981, KVP Rules 1988, NSC (VIII-Issue) Rules 1989-regarding.

- 32/2011 - Subject : Circulation of Notifications issued by Min. of Finance (DEA) notifying the changes in rules of different savings schemes effective from 1.12.2011 - regarding.

- 33/2011 - Subject : Issue of clarifications regarding premature closure of TD accounts

- 34/2011 - Subject : Procedure for opening of Savings Accounts of Below Poverty Line (BPL) households

Downlaod

List of SB Orders Released in 2012

- 1/2012 - Subject : Action Plan to “Identify potential areas of corruption related to Departmental activities/functions and develop action plan to mitigate them”- implementation of the action plan regarding

- 2/2012 - Subject : Taking of Know Your Customer(KYC) documents at the time of credit of maturity value and cash withdrawal from savings account opened without KYC documents.

- 3/2012 - Subject : Release of version 6.6.1 of sanchaya Post software.

- 4/2012 - Subject : Revision in interest rates of Small savings Schemes w.e.f.1.4.2012.

- 5/2012 - Subject : Revision in interest rates of Small savings Schemes w.e.f.1.4.2012.

- 6/2012 - Subject : Introduction of facility of transfer of quarterly interest of Sr.Citizens Savings Scheme(SCSS) accounts to any bank accounts through ECS-release of ECS for MIS/SCSS ver 2.5.5 and 3.1.5 by SDC Kolkata.

- 7/2012 - Subject : Circulation of notification issued by Min.of Finance(DEA) notifying the changes in interest rates of different savings schemes effective from 1.4.2012-regarding.

- 8/2012 - Subject : Settlement of claims where the clamant or near relatives are residing or depositor died in abroad.

- 9/2012 - Subject : Introduction of the depositor at the time of opening of saving account

- 10/2012 - Subject : Change in text of column no-2 printed in the Standardized Uniform savings bank Pass Book from page no-2 to 24.

- 11/2012 - Subject : Measures to be taken for prevention of frauds

- 12/2012 - Subject : Revision in Interest Rates of Small savings Schemes w.e.f.1.4.2012-Interest tables of Time Deposit Accounts opened on or after 1.4.2012.

- 13/2012 - Subject : Extension of facility of withdrawal of quarterly interest of SCSS accounts through Money to MIS accounts- regarding

- 14/2012 - Subject : Circulation of Master Circular No-1 on Anti Money Laundering(AML)/Combating of Financing Terrorism(CFT) norms applicable for Small Savings Schemes-regarding

- 15/2012 - Subject : Problems in Sanchay Post Software in handling Extended SCSS Accounts.

- 16/2012 - Subject : Purchase of National Savings Certificates by an adult on behalf of a minor

- 17/2012 - Subject : Applicability of Section 80C of Income Tax Act on amount invested in 10 years NSC(IX-issue)-a clarification regarding.

Download

List of SB Orders Released in 2013

- 1/2013 - Subject : Amendment in Rule 4A of Post Office savings Account Rules 1981 thereby allowing deposits other than wages under MGNREGA into workers wage Accounts.

- 2/2013 - Subject : Enhancement of limit for verification of withdrawals from savings accounts made at Extra Departmental Sub/Branch Post Offices and single handed post offices-reg

- 3/2013 - Subject : Identification of PPF(HUF) accounts and admissibility of interest in such accounts-reg

- 4/2013 - Subject : Revision of Interest rates of Small Savings Schemes w.e.f. 1st April-2013

- 5/2013 - Subject : Change of mode of dispatch of list of outstation cheques along with cheques for clearance from Registered to Insured –amendment in Rule-7(9) of Appendix –I of POSB Manual Volume-I-regarding.

- 6/2013 - Subject : Acceptance of business from SAS Agents regarding.

- 7/2013 - Subject : Admissibility of commission on deposits in POTD accounts to GDSBPMs-

- 8/2013 - Subject : Reduction of preservation period of records under prevention of money laundering (PML) Act-2002 regarding.

- 9/2013 - Subject : Introduction of “ Basic savings Account” under Post office savings Accounts Rule-1981 to facilitate opening of Zero balance Accounts by beneficiaries of any Government Welfare Scheme-Regarding.

- 10/2013 - Subject : Deduction of TDS at the time of payment of quarterly interest from SCSS accounts, withdrawal from NSS-87 accounts, payment of commission to Agents and issue of TDS certificate in Form-16A.

- 11/2013 - Subject : Problems faced by Small Savings Agents.

- 12/2013 - Subject : Change in procedure of payment of commission to SAS/MPKBY Agents and PRSG Leaders in the Post offices to be migrated to Finacle CBS Application.

Download

List of SB Orders Released in 2014

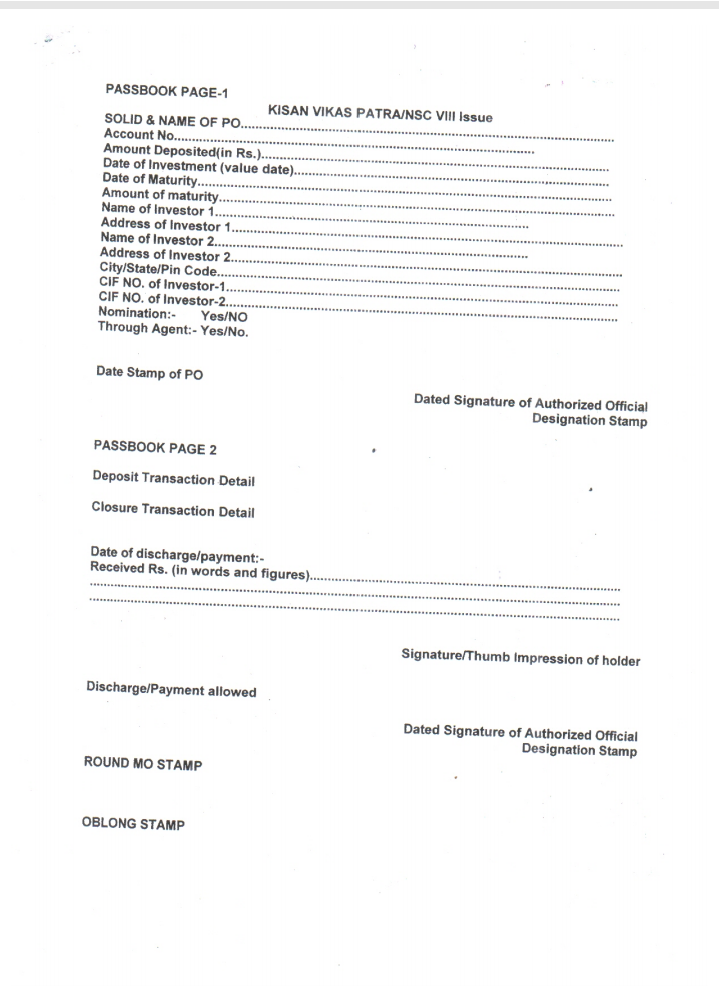

- 1/2014 - Subject : Printing of modified Standardized Uniform Savings Bank Pass Books for CBS post offices and change in text of information printed in the pass book about small savings schemes.

- 2/2014 - Subject : Change in some procedures of POSB in the backdrop of implementation of CBS-reg

- 3/2014 - Subject : Release of Sanchay Post Version 7.5-reg

- 4/2014 - Subject : Revision in Interest Rates of small Savings Schemes w.e.f. 1"t April 2014.

- 5/2014 - Subject : Changes in Statutory Rules of POSB in the backdrop of implementation of CBS-reg

- 6/2014 - Subject : Acceptance of business from SAS Agents regarding.

- 7/2014 - Subject : Amendment to Sub rule 3 od Rule 8 of SCSS 2014 rule

- 8/2014 - Subject : Clarification on different scinarios being faced or likely to be face by Post Offices after implimentation of CBS

- 9/2014 - Subject : Revision of maximum limit of subscription in a Financial Year of PPF Account

- 10/2014 - Subject : Regularization of irregularly opened MIS accounts in multiples of Rs1000/-instead of Rs1500/-

- 11/2014 - Subject : Extension of PPF Scheme to private sector banks

- 12/2014 - Subject : Re-introduction of Kisan Vikas Patra - Procedure regarding

- 13/2014 - Subject : Grant of Savings Bank allowance to Postal Assistants working in Savings Bank/Savings Certificates - Clarification

Download

Subscribe to:

Posts (Atom)

Author Name

Powered by Blogger.