1. What is Inward Clearing?

Inward clearing is a cheque drawn by a drawer (DoP customer) from a

drawee bank (DoP) in favor of a customer belonging to other bank which

is the presenting bank.

2. What is Outward Clearing?

Outward clearing is when cheques drawn by other bank customers are

presented for clearing by presenting bank (DoP) in favor of their

customer (DoP customer) to drawee bank for clear funds.

3. How do I open a zone in finacle and make entries in the zone?

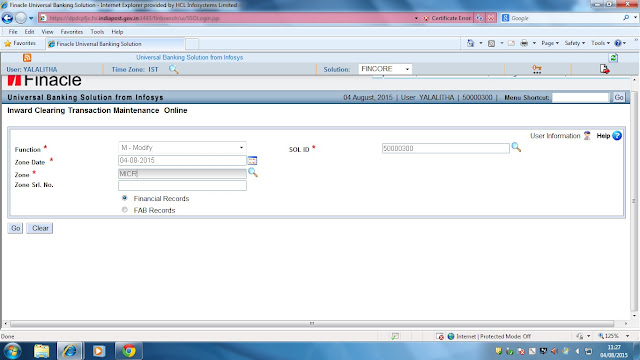

For Inward Clearing zone can be opened by using menu option HMICZ and

respective entries can be made in the zone by using HICTM menu.

For Outward Clearing zone can be opened by using menu option HMCLZOH and

respective entries can be made in the zone by using HOCTM menu.

4. What are the steps to be followed in case of Inward Clearing zone?

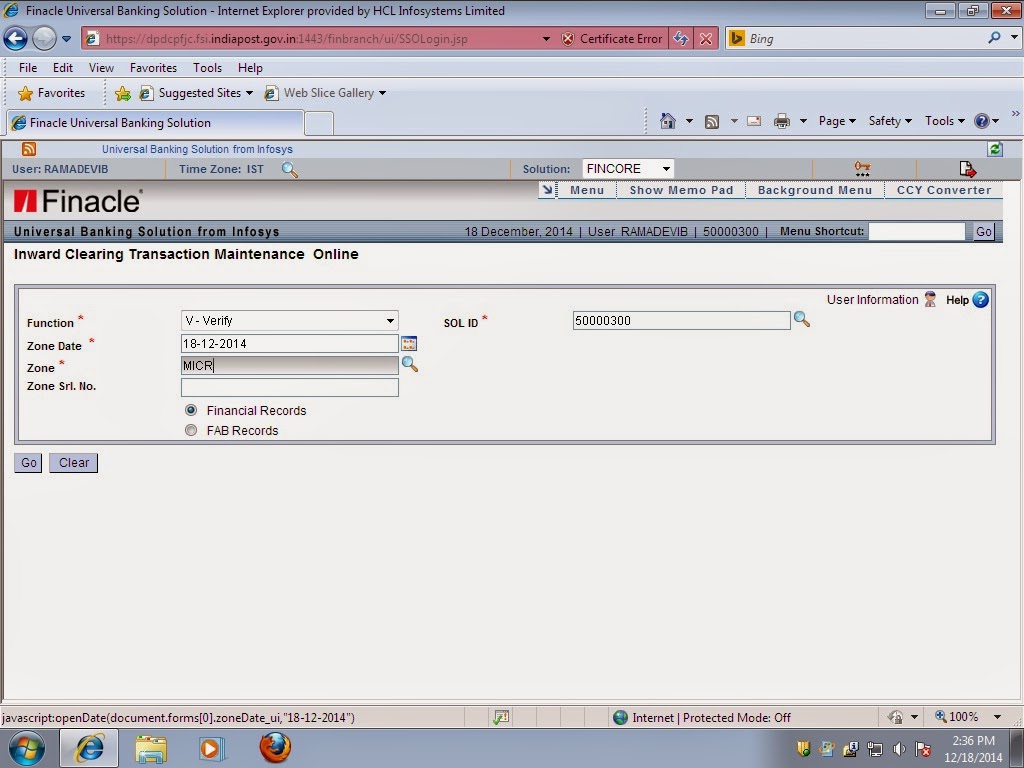

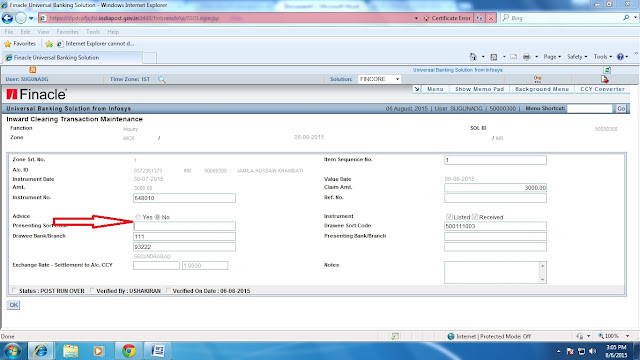

In Inward Clearing below step by step process can be followed:

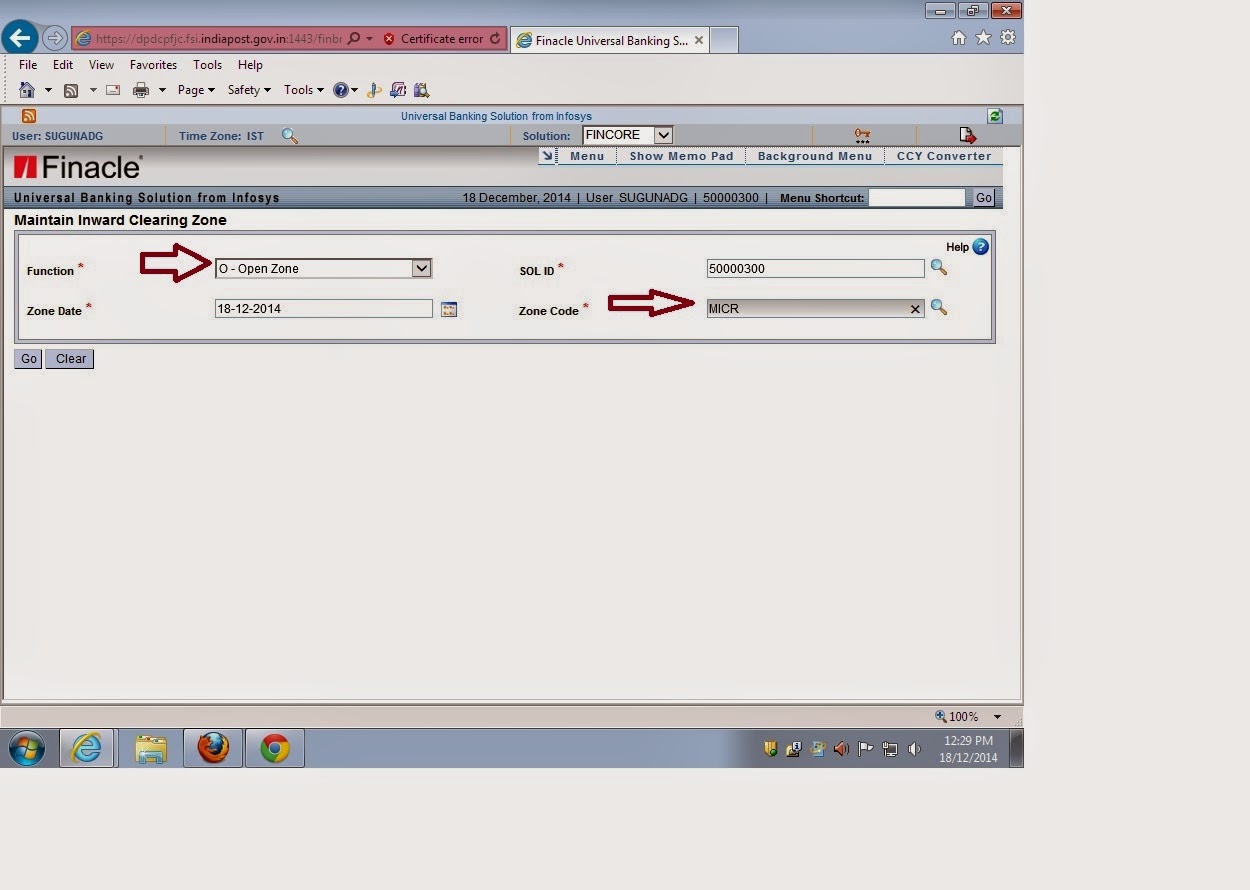

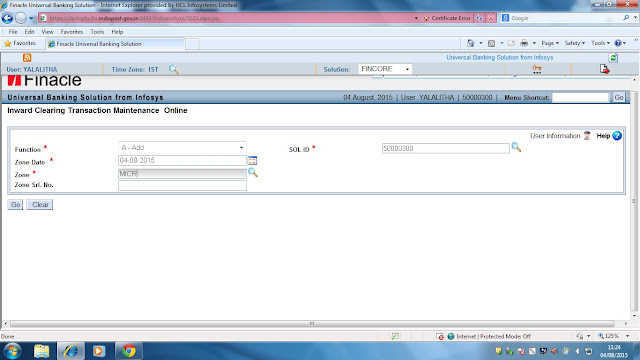

a. Open zone in HMICZ using function ‘O’.

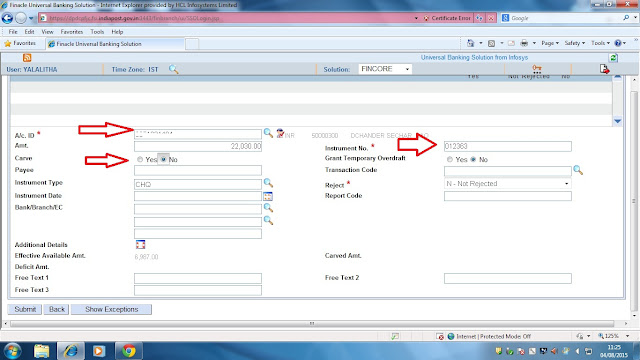

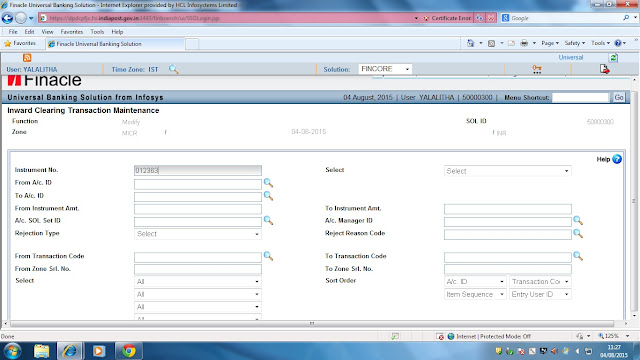

b. Make entries manually using menu HICTM or for bulk entries use menu HRMI to upload a file.

c. Authorizer to login and use menu HMICZ menu to suspend the zone.

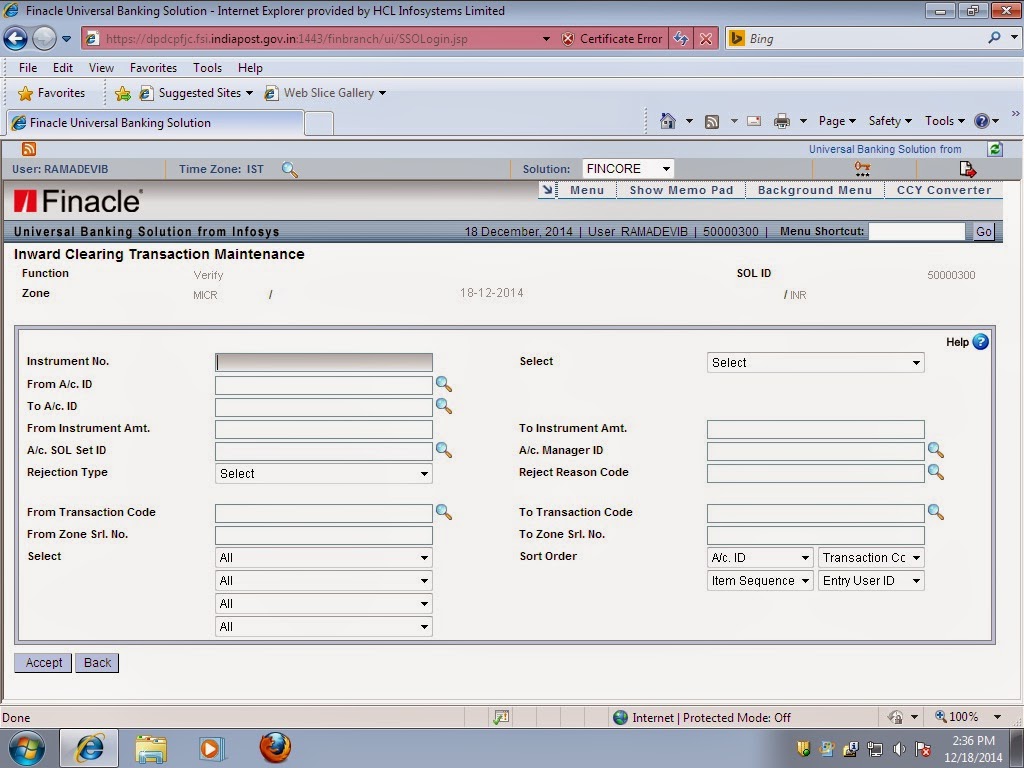

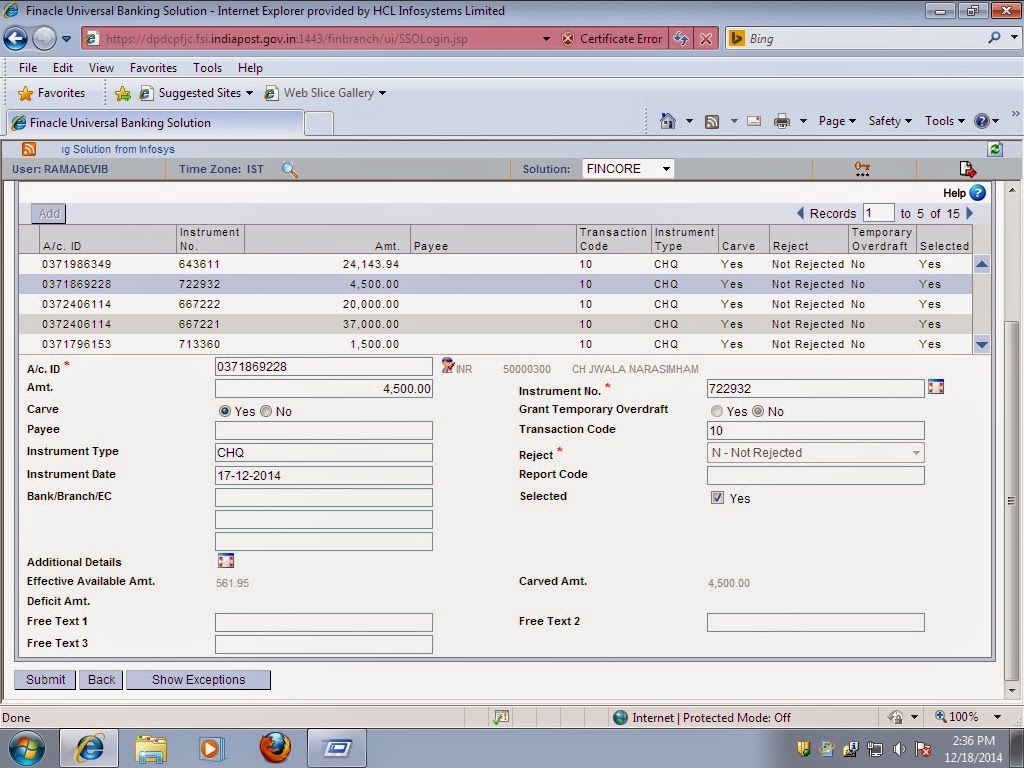

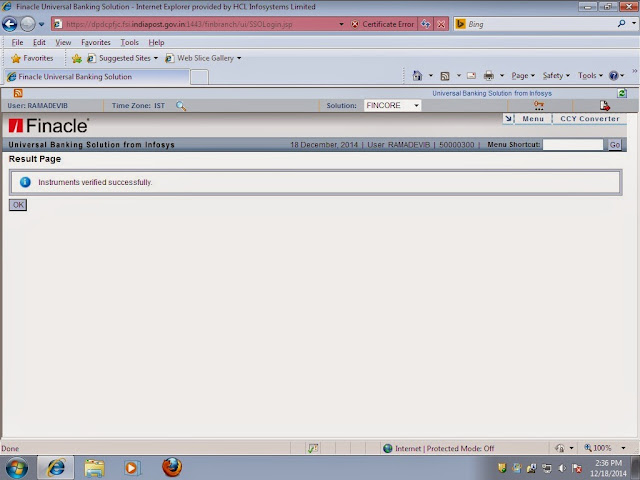

d. Then invoke menu HICTM to verify the entries uploaded.

e. Then invoke validation run report in HMICZ.

f. Check HPR validation report for any discrepancies in the accounts under clearing.

g. Then invoke HMICZ revoke the zone so that action can be taken on accounts with discrepancy.

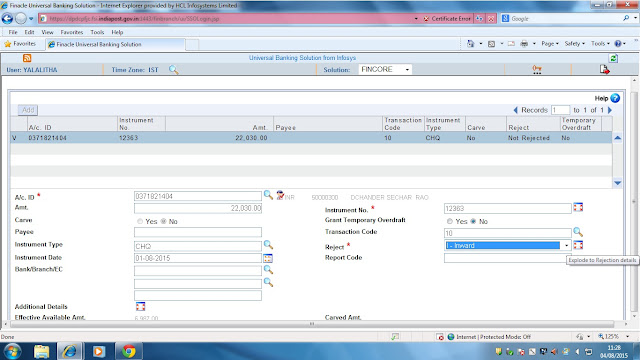

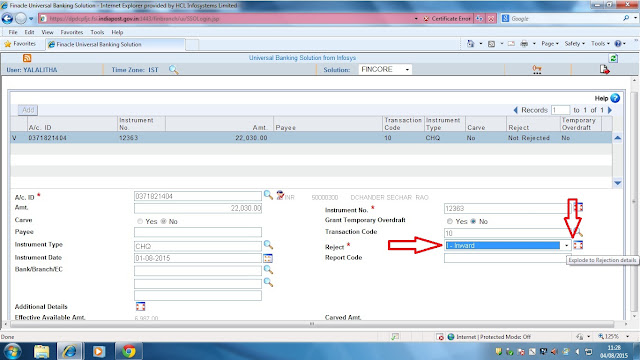

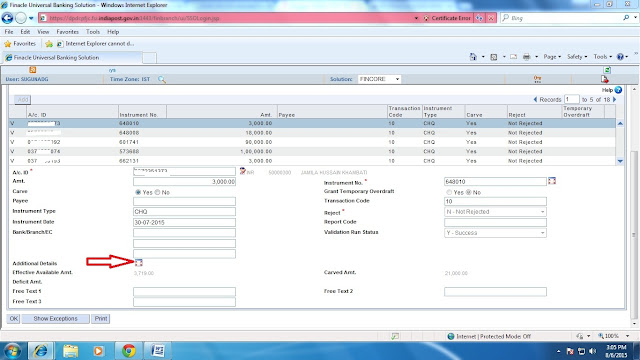

h. User to appropriately take action by rejecting the instruments in HICTM

i. Authorizer to verify the modified instruments in HICTM.

j. Then invoke HMICZ suspend the zone.

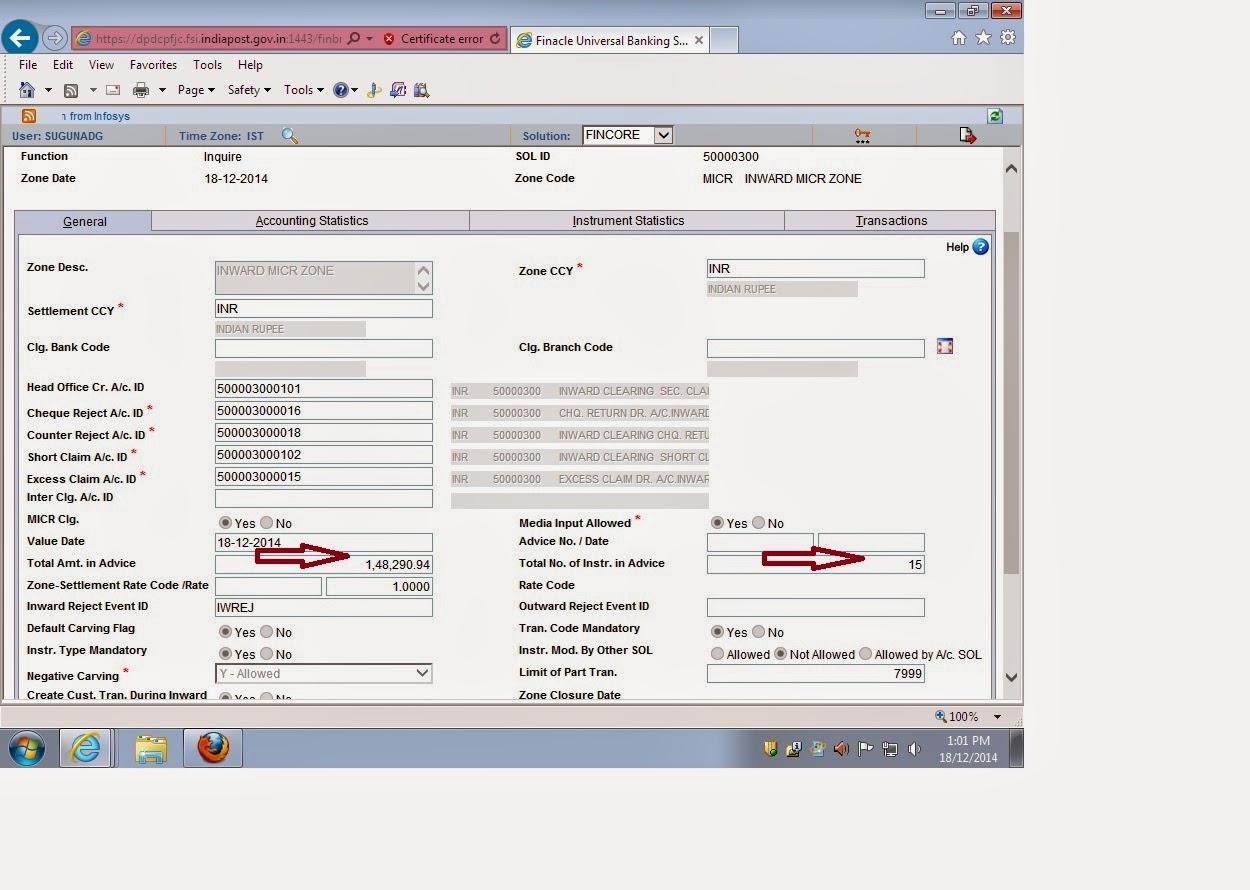

k. Invoke HMICZ check for account statistics and check for fields

received but not listed and listed but not received and make sure it is

zero so that unnecessary credit to short claim and excess claim account

can be avoided. Posting can be invoked after checking the account

statistics screen.

l. Once posting is complete proceed with closure of zone in HMICZ.

5. What if my zone is not getting posted?

a. Check for error report in HPR.

b. Check HICTM if all instruments are verified

c. Check validation status in HMICZ to be complete

6. How do I check the status of individual instruments lodged in Inward Clearing from front end?

Invoke menu HICI and give account number and click on GO.

7. What if my zone is locked?

Invoke menu HUNLKZ to unlock the locked zone.

8. What if duplicate instrument is added in the zone?

Section A – shows the Information when the issue is faced.

If duplicate instrument is added in the zone and user did not check the

validation report and posting has been initiated. In such case system

will create a partly posted transaction with un-posted part tran in

entered status and consolidated amount in SHORT CLAIM account for all

the duplicate cheque entries.

Section B – shows steps to be taken to solve the issue

In such cases user to follow below approach:

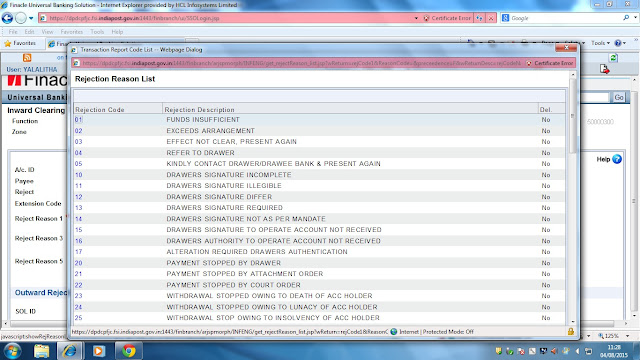

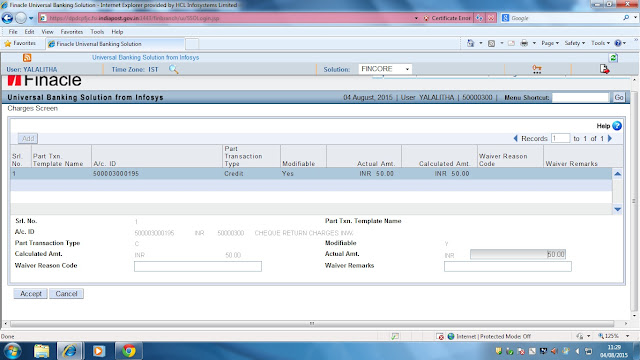

Mark the duplicate instrument as rejected with appropriate reject reason

code. Also see that if any charges are applied to the customer, the

same need to be reversed / amount of the charges to be collected can be

made as “zero” in HICTM screen. Please refer the below document for step

by step process.

9. What are the steps to be followed in case of Outward Clearing?

a. Open zone in HMCLZOH using function ‘O’.

b. Make entries manually using menu HOCTM or for bulk entries use menu HCLUPLD to upload a file.

c. Authorizer to login and use menu HMCLZOH menu to suspend the zone.

d. Then invoke menu HOCTM to verify the entries uploaded.

e. In case of any bank not participating in return clearing for Inward

invoke menu HMARKPND to markpend all those instruments or bank as a

whole to hold these instruments.

f. Then invoke HMCLZOH to release the zone to shadow balance.

g. For rejection of outward instruments user to open inward zone OWRTN-MICR.

h. User to appropriately take action by rejecting the instruments in HICTM

i. Authorizer to verify the modified instruments in HICTM.

j. Then invoke HMICZ suspend the zone.

k. Invoke HMICZ check for account statistics and check for fields

received but not listed and listed but not received and make sure it is

zero so that unnecessary credit to short claim and excess claim account

can be avoided. Posting can be invoked after checking the account

statistics screen.

l. Once posting is complete proceed with closure of zone in HMICZ.

m. Similarly in HMCLZOH, initiate regularization of the zone and proceed with closure of the zone in HMCLZOH.

10. What if a customer had deposited a non DoP cheque in outward clearing and funds are not available in the account?

- User to invoke HOIQ menu to check the status of the deposited cheque.

- Check HACLI to check for field “Funds in Clearing”.

11. How do I check the status of inward and outward zone?

- Invoke HMCLZOH for outward clearing and inquire on the zone status.

- Invoke HMICZ for inward clearing and inquire on the zone status.

12. What if I have all part transaction released to shadow balance have not been posted?

- Invoke HMCLZOH to check the status of the zone. If in released status proceed with regularization.

- Invoke HTM and post the transaction.

13. What if regularization of zone is not happening?

Invoke menu HMARKPND and check for any mark pending done for any

instrument or bank. If record exists, invoke menu HREVPND for revoking

the mark pending done. Post this regularization can be done in menu

HMCLZOH.

14. What if a wrong date (stale date or future date which is more than 3 months from existing date) is entered?

- User to check validation run report and modify the record in HICTM and correct the date.

15. What if accounts in outward clearing have received the credit and the zone status shows as released to shadow balance?

This is due to mark pend done on some instruments in menu HMARKPND and

regularization done in HMCLZOH where other than mark pend instruments

receive the credit and others remain in released to shadow balance along

with the outward zone MICROW. Invoke HREVPND to revoke the mark pend

and proceed with remaining zone regularization of zone in HMCLZOH.