With some tinkering in the income tax rates for 2017-18, Finance Minister Arun Jaitley reduced the tax rate for income between Rs. 2.5 lakh and Rs. 5 lakh to 5 per cent in the Union Budget, while adding a surcharge of 10 per cent on tax for income between Rs. 50 lakh and Rs. 1 crore.

Although the basic income tax exemption limit remains the same at Rs. 2.5 lakh, there are many exemptions available in the Income Tax Act, which can substantially reduce your tax liability.

One needs to plan from the beginning of the next financial year to take maximum benefit of the income tax deductions available.

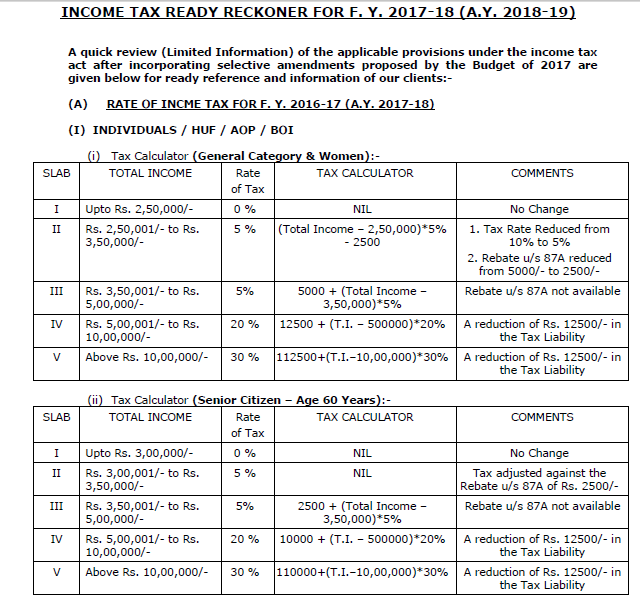

Here are the new income tax slabs for taxpayers:

General category

|

Senior citizens

|

Super senior citizens

|

(Up to 60 years of age)

|

(60-80 years)

|

(Above 80 years)

|

Income

|

Tax

|

Income

|

Tax

|

Income

|

Tax

|

Up to Rs. 2.5 lakh

|

Nil

|

Up to Rs. 3 lakh

|

Nil

|

Up to Rs. 5 lakh

|

Nil

|

Rs. 2,50,001-Rs. 5 lakh

|

5%

|

Rs. 3,00,001-Rs. 5 lakh

|

5%

|

Rs. 5,00,001-Rs. 10 lakh

|

20%

|

Rs. 500,001-Rs. 10 lakh

|

20%

|

Rs. 5,00,001-Rs. 10 lakh

|

20%

|

Above Rs. 10 lakh

|

30%

|

Above Rs. 10 lakh

|

30%

|

Above Rs. 10 lakh

|

30%

| | |

# Surcharge of 10% for income between Rs. 50 lakh and Rs. 1 crore

|

# Surcharge of 15% for income above Rs. 1 crore

|

# Rebate of up to Rs. 2,500 for taxable salary up to Rs. 3.5 lakh

|

# Education and higher education cess of 3%

|

Here are the some of the deductions available for FY2017- 18:

House Rent Allowance under Section 10 (13A) of the Income Tax Act

House Rent Allowance, commonly known as HRA, makes up a major chunk of a salaried individual’s total pay. HRA is partly exempted from tax. If you are staying in your own house or not paying any rent, your HRA will be completely taxable. However, those who stay with their parents can also claim HRA benefits by paying rent to their parents.

The amount which is allowed for exemption under HRA is calculated as minimum of:

1) Rent paid annually minus 10 per cent of basic salary plus dearness allowance

2) Actual HRA received

3) 40 per cent of basic and dearness allowance (50 per cent in case of metro cities)

Deductions under Section 80C

Section 80C of the Income Tax Act provides various provisions under which an individual can get deduction benefits up to Rs. 1.5 lakh. Employees’ Provident Fund (EPF), Public Provident Fund (PPF), Sukanya Samriddhi Account, National Savings Certificate and tax-saving fixed deposits are some of the investment options that offer benefits under Section 80C. The premium paid for life insurance plans, National Pension Scheme (NPS) and tax-saving mutual funds (ELSS) also qualify for deduction under Section 80C.

Further, one can claim tuition fees paid for up to two children, principal repayment on home loan, stamp duty and registration cost on the house bought as deduction under Section 80C.

Deductions under Section 80CCD(1B)

Introduced in Budget 2015-16, Section 80CCD (1B) provides deduction up to Rs. 50,000 for investment in NPS Tier 1 account. This deduction is over and above the deduction available in Section 80C. An individual in 30 per cent tax bracket can save up to Rs. 15,450 of tax by investing Rs. 50,000 in NPS.

Deduction of interest on housing loan (Section 24B)

Buying a house is among several other things an individual wants to do during his or her lifetime. The income tax rules also incentivise the same. Under Section 24B of the Income Tax Act, interest paid up to Rs. 2 lakh on housing loan and up to Rs. 30,000 on home improvement loan is allowable as deduction from your taxable income.

The government has however cut down tax benefits borrowers enjoyed on properties let out on rent. As per current tax laws, for properties rented out, a borrower could deduct the entire interest paid on home loan after adjusting for the rental income. On the other hand, borrowers of self-occupied properties get Rs. 2 lakh deduction on interest repayment on home loan.

However, according to the proposed change in Budget 2017, on rented properties, the borrower can only claim deduction of up to Rs. 2 lakh per year after adjusting for the rental income. And the amount above Rs. 2 lakh can be carried forward for eight assessment years.

Since the interest component of home loan repaid in initial years is higher, experts say that the borrower may not be able to fully adjust the interest paid as deduction even in subsequent years.

Deduction under Section 80EE

Under Section 80EE, an additional deduction of Rs. 50,000 is available over and above the limit of Section 24B on interest paid on home loans if the person is buying a house for the first time (the person must not own any other residential property on the date of sanction of loan). However, to avail the benefit of this section the value of the property must be below Rs. 50 lakh and the loan amount should not exceed Rs. 35 lakh. Further, the property must be bought after April 1, 2016.

Deduction under Section 80D

Premium paid for medical/health insurance for self, spouse, children and parents qualify for deduction under this Section. On can claim deduction of Rs. 25,000, if he is below 60 years of age, and Rs. 30,000 if he is above 60 years of age, towards medical insurance premium paid for self, spouse and children. Further, additional deduction of Rs. 25,000 is available if one has bought medical insurance for his parents. This deduction can go up to Rs. 30,000 if parents are above the age of 60 years.

Deduction under Section 80DD

If a tax payer has dependent parents, spouse, children or siblings who are differently-abled, then he can claim deductions up to Rs. 75,000 for expenses on their maintenance and medical treatment under this section. This deduction can increase to Rs. 1.25 lakh in case of severe disability.

Deduction under Section 80DDB

Under this section, one can claim deduction of Rs. 40,000 for treatment of certain diseases for self and dependents. The deduction can go up to Rs. 60,000 if the tax payer is above 60 years of age and if he is above 80 years of age, then the deduction amount is up to Rs. 80,000.

Deduction under Section 80E

According to the provisions of Section 80E, a taxpayer can claim deduction for interest paid on education loan for him, spouse or children. There is no upper limit on the amount of deduction. However, the loan must have been taken from a financial institutional or approved charitable institution and for full-time higher education.

Source: NDTV