A complete Guide for DOP Finacle, McCamish, CSI, RICT & IPPB

Articles by "Finacle"

15G

15H

7th CPC

Aadhaar

Aadhaar Fees

Aadhaar Operations

Aadhaar Software

Aadhaar Survey

AAO

ABVKY

Account

Account Opening Form

Accountant Exam Books

Accountants

Accounts Officers

Active Directory

AD login

AD Rollout

Adhoc Norms

Agent Creation

Agent Portal

Agents

Air Tickes

Allowance

Android App

APAR

APS Accounts

APY

Arrears

ATM

ATM Cash Loading

ATM Form

Audit Para

AV Rollout

Bank Reconciliation

Bank Transfer

Biometric Device

Black Money

Blocking Validations

BNPL

BO

BO Device

BO Rules

BO Slip

BO Slip Generator

BO Transactions

Bonus

BOOKS

BPC

BPM

BPM Arrears Table

BPM Transfer

Branch Office

Browser Settings

Budget

Bulk

Bulk Booking

Bulk Closure

Bulk Upload

Bulk Upload File Creator

Business

Business Hours

Business Parcel

Cadre Restructuring

Calculator

Cash & Bank

Cash Handling Allowance

Cash Management

Casual Labour

CBS

CBS Commands

CBS FAQ

CBS-CSI

CCS Rules

CEA

Central Government Employees

Central Vigilance Commission

Certificate Printing

CGEGIS

CGHS

Check List

Cheque

Cheque Book

Cheque Lot Creation

Cheque Request

Cheques Clearing

Child Card Leave

Children Education Allowance

Circulars & Orders

CIS

Claim Settlement

Clarification

Close Account

Closure

COD

Compare and Book

Configuration

Contract Creation

Court News

CPAO Orders

Creation of CIF

CRM Portal

CSD

CSI

CSI Daily Work Flow

CSI Hand Book for RMS

CSI Helper Tool

CSI Master Guide

CSI Templates

CSI Tool

CSI Tools

CSI Training Manual

CSI Updates

CSI Utility Tool

CSV File Generator

CSV Uploading

Currency Ban

Currency Exchange

Customer Creation

Customer Portal

DA

DA Freeze

DA News

DA Orders

DARPAN

Dearness Allowance

Dearness Relief

Death Claim

Default Fee

Demonetization

Department Exams

Department of Expenditure

Department of Posts

Departmental Examination

Desktop Configuration

Desktop Settings

Despatch

Despatch Schedule

DEST

Digital India

Digital Life Certificate

Digital Payment

Directorate

Directorate Appeal

Directorate Order

Disbursement

Discrepancies

Document Reversal

DOP

DOP Core Solutions

DOP CSI Hand Book

DOP Finacle Guide

DOP IFSC Code

DOP Internet Banking

DOP Mobile Banking

DOP News

DOP Orders

DOP Rulings

DoPT

DoPT Order

DoT

DPMS

Drivers

DSA

Dte Orders

Duplicate

e-Banking Form

e-Commerce

e-Commerce Portal

e-Services

Earned Leave

ECB Memo

ECMS

ECMS Settings

Emergency Leave

eMO

eMO Workflow

EMOs

EMOs Procedure

Employee Online

Employee Portal

Employee Transfer

Employment News

End User

Enumeration

EO App

EOD

ePay Billers

ePayment

ePost

Epson

Errors & Solutions

ESS

Establishment Register

EWS Reservation

Express Parcel

Extension

External Antenna

F&A

Family Pension

FAQ

Finacle

Finacle Guide

Finacle Guide Book

Finacle Updates

Financial Powers

First Day on Finacle

Five Day Week

Fixed Stationary Charges

Flow Chart

Fmenu

Form 60

Forms

Forms & Documents

Franchised Outlet

FRSR

FSC

Gazette Notification

GDS

GDS Committee Report

GDS New Pay Table

GDS Transfer Policy

GEM

General

General Financial Rules

General Ledger Sub Head Code

General News

GL Accounts

GL Codes

GL Integration

Govt Orders

GPF

Gratuity

GST

Guide Lines

Guidelines

HBA Rules

HFINRPT

Hindi

HO

Honorarium

House Building Advance

HR

HR Solutions

HRA

Identity Card Form

iMO

Incentive

Incentive Structure

Income Tax

Income Tax Saving

Increment

India Post

India Post Mail

India Post Toll Free

Info Type

Inspector of Posts

Install Mantra Device

Installation

Inter SOL

Interest Calculator Lite

Interest Rates

Interest Rates Data

Interest Statement

International Mail

International Parcel

Internet Banking

Internet Explorer Settings

Inventory

Inventory Management

Inventory Movement

Inventory Status Report

Inward Clearing

Inward Rejection

IP

IP Exam Syllabus

IP&ASP

IPO Indent

IPOs

IPPB

IPPB CBS MENUS

IPPB FAQ

IPPB Finacle Menus

Issue

Issue Cheque

Issue Cheque Book

Issue Duplicate Certificates

Jan Suraksha

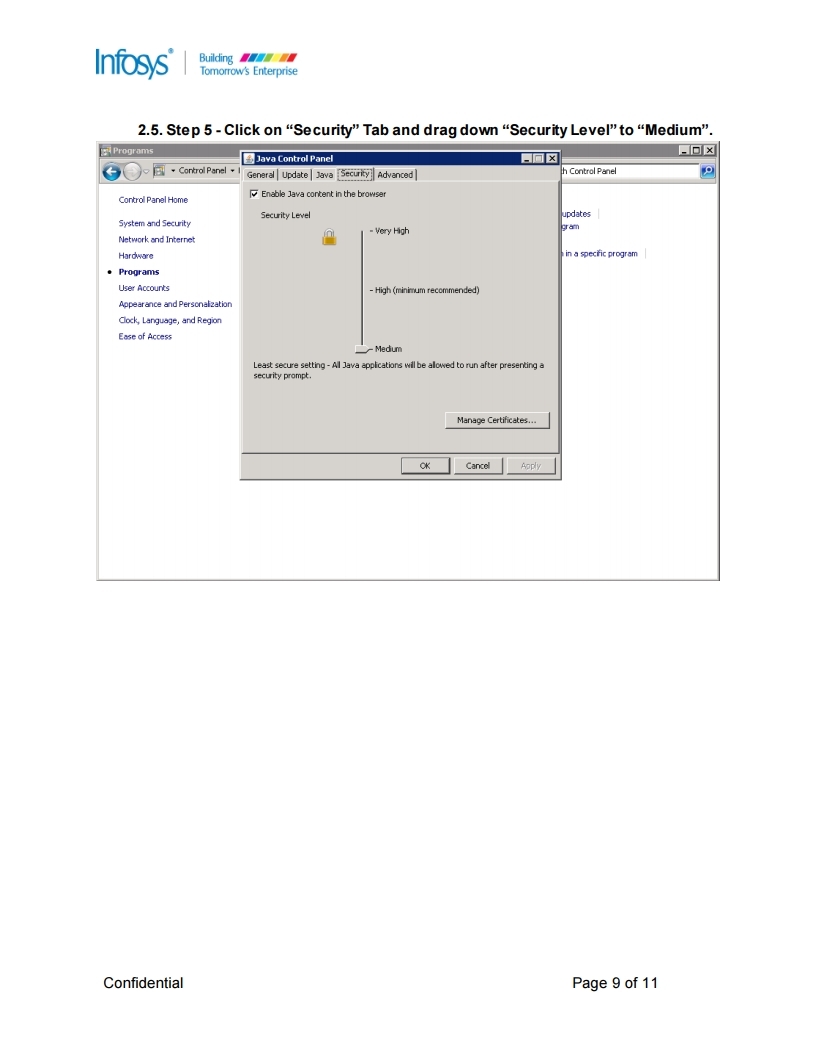

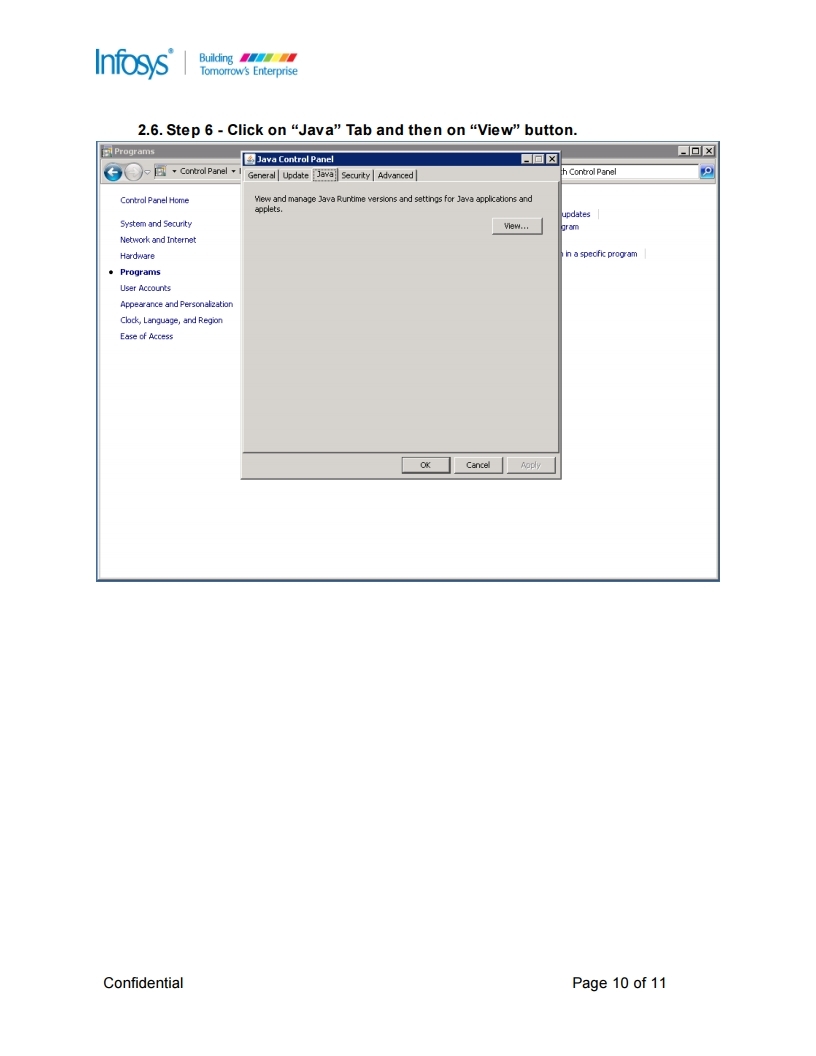

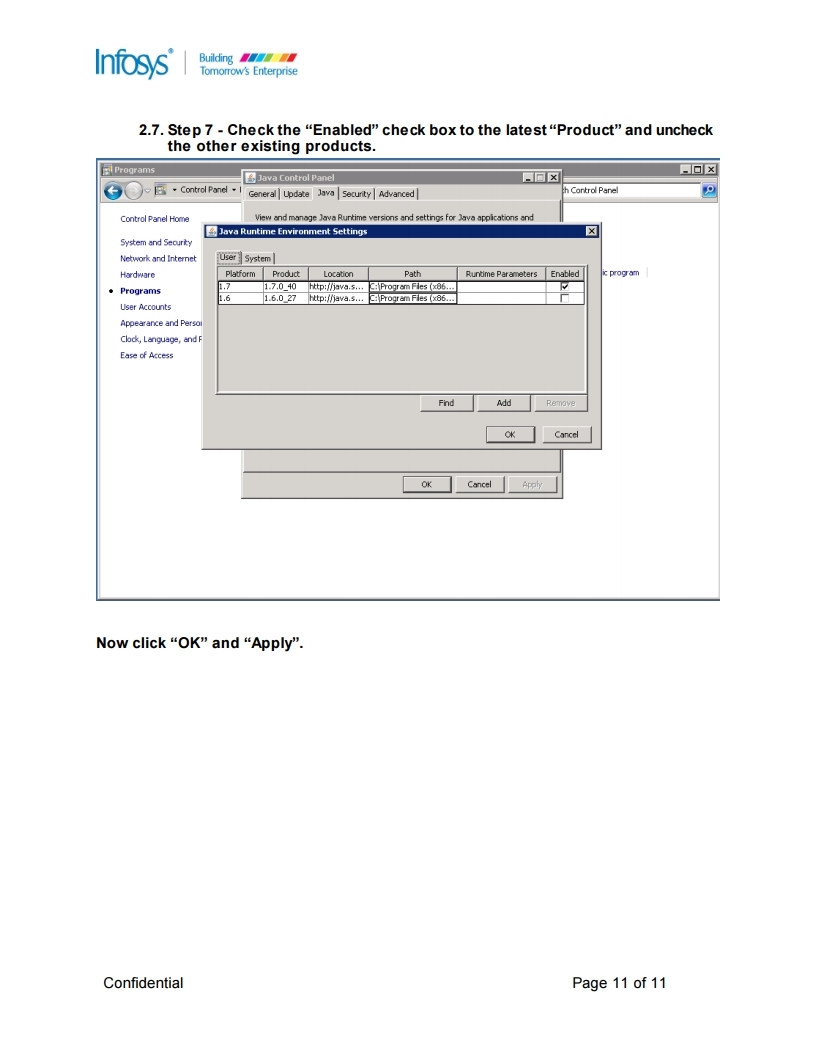

Java

Jeevan Pramaan

Judgement

KVP

KYC

LDCE

Leave

Leave Management

Leave Rules

Ledger Inquiry

Legacy Document Upload

Letter to Dte

LGO Exam

Liability Document

Life Certificate

Lipi Passbook Printer

List Of Balance

List of Holidays

List of Office Accounts

List of Run Commands

Live Account Report

Loan

Loan Account

Loan Account Opening

Loan Repayment

LTC

MACP

Mail Booking

Mail Guard

Mail Operations

Marketing

Marketing Executives

Mass Official Transfer

Material

Material Balance

Maternity Leave

Maturity Calculation

McCamish

MCD

MDM

Meghdoot

Menu List

Merchant Mobile App

MGNREGA

Micro ATM

Ministry of Finance

MIS

MIS Server

Mobile Banking

Mobile Banking Form

Mobile Charges

Mobile Number

Mobile Wallet

MPKBY

MTS

Name Change

National Pension System

New Pension Scheme

New Policy Bond Formats

New Services

NJCA

NJCA Meeting

Nominal Role

Nominee

NPS

NSC

NSS

Objections

Official Transfer

Offline Update

Online

Online Payment

Online Registration

Online Training

Open Account

Operations Guide

OSL

OT

Outsource Agents

Outstation Cheques

Outward Cheque Status

Outward Clearing

Outward Rejection

Overview

Ownership Change

Part Closure

Part Withdrawal

Passbook Printing

Passbook Reprinting

Paternity Leave

Pay & Allowance

Pay Commission

Pay Fixation

Pay Revision

PAYROLL

Payslip

Pension

Pension Upload

Pensioners

Pensioners News

PFRDA

Pincode Tool

Pineapple

PLI

PLI Bonus

PLI Terms

PMJJBY

PMLA

PMSBY

PO Finacle Guide

Point of Sale

POLI Rules

POS

POS Back Office

PoS Machine

POS Server

POSB

Post Office

Post Office IFSC Code

Post Office Operation Guide

Post Office Workflow

Postal Assistants

Postal Exams

Postal Manuals

Postal Savings Schemes

Postman

Postman Examination

Postman Mobile Application

Postmaster Cadre

Postmaster Grade-1

PPF

PPF Deposit

Precautions

Prerequisites

Prevent Frauds

Print Bond Queue

Printer Settings

Printing

Procedure

Promotion

Proposal Forms

Pushback

QR Cards

Questions & Answers

Quick TCB

RBI

RBI Order

RD

RD Deposit

RD Loan

RD Loan Account

RD Services

Ready Reckoner

Receipt Cancellation

Recruitment

Recruitment Rules

Register Letter

Reimbursement

Remuneration Pay

Renewal

Report

Reports

Reservation

Retirement

Reversal

Reversal of Clearing Document

Revised Service Request Forms

Revision of Interest Rates

RFMS Tcodes

RICT

Risk Allowance

Rlist

RMFS

RMS CSI Guide

Rotational Transfers

RPLI

Rule 38

Rules

Rulings

Rural ICT

Salary

Salary Account

Salary Upload

SAP

Saving Schemes

Savings Account

Savings Schemes

SB

SB Deposit

SB Orders

SB Withdrawal

SBCO

SBI Buddy

SCSS

Security Tips

Senior Citizen

Seniority

Service Desk

Service Tax

SETID

Settings

SGB

Short Notes

Shortcut Keys

Simple CSI Assist

SMS Alerts

SMS Banking

SO

SO Slip

SO Slip Generator

Software Configuration

Softwares

SOP

Sorting Assistants

Sovereign Gold Bonds

Speedpost

Speedpost Booking Machine

Split Cheque Book

Sports

SSA

SSC CHSL 2016

Staff Scheduling System

Stamp Balance

Stamp Indent

Stamps

Standing Instruction

Stenographer

Step by Step CSI Guide

Stock

Stop Payment

StopDB

Strike

Study Materials

Super User

Syllabus

Symantec

Sync Issues

System Administrators

T-Codes

Tarrif

Tax Slabs

TCB

TD

TDS

Teller Cash Balance

Tenure

Tools

TPTA

Training Allowance

Training Application

Training Manual

Transfer

Transfer In

Transfer of Accounts

Transfers & Postings

Travelling Allowance

Treasury Allowance

Trial Close

UIDAI

UIDAI Circular

Union

Union News

Updates

UPSC

User Guide

User Manual

Vault Operations

Video

Viewing Documents

Vigilance

VP Articles

VP Intimation

Weblink

Webmail

Welfare

Will

Windows Tips

Withdrawal

Workaround

Workflow

WUMTS

Showing posts with label Finacle. Show all posts

Accounts opened in Contravention of Rules - Clarification

June 11, 2019

Finacle

,

POSB

,

SB

ACCOUNTS OPENED IN CONTRAVENTION OF RULES

(SB Order 09/2018, POSB(CBS) Manual Page No. 27 &28)

25 (1) If an account is opened in contravention of the P.O.S.B. General Rules, 1981, the account should be closed under the orders of the Head Postmaster. No further transaction should be allowed in it. If any annual interest has been credited in the account, it should be adjusted at the time of closure of the account through the register of rectification of interest and a remark of adjustment made in the ledger folio. A written notice in the following form should be sent to the depositor indicating the irregular opening with a request to close the account within 30 days of issue of notice and take the withdrawal payment personally or through an agent. If the depositor does not comply with the request within 30 days, the account may be closed and the amount remitted by crossed cheque after deducting the interest if any already paid.

SPECIMEN OF NOTICE

NOTICE

Dear Sir/Madam,It is noticed that your account No. ……… has been opened in contravention of rule (4) of the Post Office Savings Account Rules, 1981. As no interest is admissible on the deposits in such account vide rule 17 of P.O.S.B. General Rules, 1981, I request you to close the account immediately. You may present your pass book at …… office together with an application for withdrawal and receive payment of the amount at your credit either personally or through an agent. If, however, you failed to close the account within 30 days of issue of this notice, the amount will be remitted to you by cheque after deduction of amount of interest if paid any and the postage charges from the amount at credit.

Yours faithfully,

Postmaster

|

(2) At the Head Office: - If an account had been opened at the head office, action for its closure will be taken in the usual manner when the pass book is presented by the depositor. Since no interest will be admissible, care should be taken to see that annual interest, if any, allowed on the account prior to the issue of the notice is adjusted from the balance at credit while making the payment.

Note: When the fact of opening the account in contravention of Rules come to the notice, supervisor has to take steps to freeze the account immediately so that no further transactions can be done in such accounts.

(3) At the Sub Office including its Branch Offices: - In case the account had been opened at sub/branch office, sub postmaster will send a notice to the depositor The notice should contain instructions to the effect that no further transaction should be allowed in the account. The balance in the account as in the sub office record as also the amount of annual interest credited to the account, if any, that has to be adjusted at the time of closure of the account should be intimated. When the pass book is presented at the sub office and the balance in the pass book tallies with finacle, the sub postmaster should take action to close the account without further reference to the head office and return his copy of the notice along with the warrant of payment.

Note: When the fact of opening the account in contravention of Rules come to the notice, sub postmaster has to refer the case to head office along with prescribed documents to freeze the account immediately so that no further transactions can be done in such accounts

(5) In case of branch office, the application for withdrawal and the pass book will be received in the account office which should take action to authorize payment and return the warrant of payment and the pass book to the branch office. In case, there is a difference between the balance in the pass book and balance in Finacle CBS Application, the pass book and the application for withdrawal should be sent to the head office and further action taken in accordance with the instructions received from the head office.

Source: SB Order 09/2018, POSB(CBS) Manual Page No. 27 &28

डाकघर के खाते को IPPB के खाते से कैसे जोड़ें ??? (Link/De link With POSB to IPPB)

June 01, 2019

Finacle

,

IPPB

,

POSB

,

SB

If the POSB account is not linked to IPPB account while opening account,

it can be linked subsequently on customer request. Following is the

procedure for linking POSB account with IPPB account

Finacle command used for linking is CLDPOSB

Same command is also used to delink account

Following screen will appear

Select Function - Link

Enter IPPB Account Number. On clicking tab details like Aadhaar number,

Name of customer and mobile number will automatically come.

Enter POSB Account number and DOP CIF ID

Select consent and Agent Declaration

Click on Generate OTP

Enter six digit OTP and press tab to enable Validate OTP.

On clicking Validate, message for successful linking will appear

Very Important : Updation of Mobile number for ATM card linked CIFs

Dear All,

This unit is receiving huge number of complaints regarding non-receipt of SMS alerts for the transactions done by POSB customers which may result in misappropriation of funds. Respective counter PA and Supervisor will be held responsible in case if any ATM card is issued without updating valid mobile number at CIF level. The list of such accounts are pushed in SFTP path mentioned below. Please download the file and extract the data pertaining to your circle and circulate the details to the respective SOLs to get mobile number updated immediately.

The cards will be blocked by the date which was already communicated vide this office email dated 05 Feb 2019, if mobile numbers are not updated on time.

Circle wise consolidated list is as under :

Circle

|

Count

|

ANDHRA PRADESH

|

107630

|

TAMILNADU

|

92052

|

BIHAR

|

70356

|

KARNATAKA

|

64434

|

WEST BENGAL

|

60746

|

MADHYA PRADESH

|

53031

|

UTTAR PRADESH

|

46384

|

RAJASTHAN

|

39227

|

ORISSA

|

38543

|

GUJARAT

|

37916

|

TELENGANA

|

37191

|

KERALA

|

36082

|

MAHARASHTRA

|

35087

|

PUNJAB

|

29725

|

DELHI

|

23150

|

JHARKHAND

|

13537

|

ASSAM

|

11189

|

CHATTISGARH

|

10137

|

UTTARKHAND

|

10006

|

HIMACHAL PRADESH

|

9999

|

HARYANA

|

8021

|

NORTH EAST

|

5415

|

JAMMU KASHMIR

|

2871

|

Grand Total

|

842729

|

Path for downloading the detailed excel file.

/CBSDM/incoming/Production/WebPage/DOP_REPORTS/ATM cards issued without mobile numbers

Password to open the file : NAU@2019

Thanks & regards,

Incharge Operations, DOP ATM Unit

CBS-CPC, 4th Floor, Bengaluru GPO Building

Bengaluru-560001

Toll free - 18004252440

Very Important : Notice regarding updation of Mobile numbers at CIF level

February 08, 2019

ATM

,

Finacle

,

SB

,

SMS Alerts

Dear All,

This unit is receiving huge number of complaints regarding non-receipt of SMS alerts for the transactions done by POSB customers which is resulting in misappropriation of funds. Respective counter PA and Supervisor will be held responsible in case if any ATM card is issued without updating valid mobile number at CIF level. If not updated by 15 Feb 2019, all the ATM cards without mobile number at CIF level will be blocked centrally by NAU without any prior notice.

Hence below mentioned message should be prominently displayed in notice board, counters, DOP ATM premises and where ever feasible in regional language as well as in English.

"Dear POSB customer, Please get your mobile number updated at your home branch PO immediately for receiving SMS alerts. Your DOP ATM card will be blocked with effect from 15 Feb 2019, if mobile number is not updated.."

Thanks & regards,

Incharge Operations, DOP ATM Unit

CBS-CPC, 4th Floor, Bengaluru GPO Building

Bengaluru-560001

Toll free - 18004252440

postatm@indiapost.gov.in

Streamlining Debit Entries in Office Account 0382 for Outward Cheque Clearance

Dear all,

I am directed to convey the following

This is regarding the Interim solution for the issues reported on account of streamlining debit entries in office account 0382.

Post offices were not able to open new accounts or subsequent deposits due to following reasons.

1. POs where cheques were cleared and credits available in 0382 office account , but the debit balance was made zero on 21/01/2019 for the office account ( 0382).

2. POs where cheques were not lodged but office account 0382 was debited directly for opening new account and subsequent deposits. These POs have not followed the mandated cheque clearing process.

Though instructions were given to utilise the credits in 0382, many SOLs have failed to open new accounts / subsequent deposits for the credits which were available in 0382.

It is seen that many HOs are not using zone operations for cheque clearing. POs are directly debiting funds after cheques are cleared. Validations have been built to restrict transfer in CXFER. POs are requested to follow cheque clearing process scrupulously to ensure that sufficient funds are available in office account 0382 after regularisation of cheques. It is seen that only 3876 SOLs have credits in 0382 and 157 SOls are having credits in 0017 through zone operations for the month of January 2019.

It is suggested that the concerned HOs can lodge the cheques once again and credit 0382 account post approval of the concerned Division. These relodged cheques should not be sent to clearing house again as these cheques have already been accounted. We can allow this re-lodging till 29/01/2019. SOLs can regularise the zone and cheque amount can be utilised for deposits/account opening with the original clearing date as value date. This will also ensure that the SOLs under scenario 2 explained above, will commence zone operations and proper utilisation of 0382. Divisions to ensure that relodging is completed before 29/01/2019.

Cheques pending for account opening/subsequent deposits to be consolidated and lodged on same day after approval from Divisional head. It is responsibility of the POs to ensure that only those cheques which are cleared and accounted already but not utilised for account opening/subsequent deposits to be lodged again.

Please revert in case of any issues.

This has the approval of DDG FS sir.

I am directed to convey the following

This is regarding the Interim solution for the issues reported on account of streamlining debit entries in office account 0382.

Post offices were not able to open new accounts or subsequent deposits due to following reasons.

1. POs where cheques were cleared and credits available in 0382 office account , but the debit balance was made zero on 21/01/2019 for the office account ( 0382).

2. POs where cheques were not lodged but office account 0382 was debited directly for opening new account and subsequent deposits. These POs have not followed the mandated cheque clearing process.

Though instructions were given to utilise the credits in 0382, many SOLs have failed to open new accounts / subsequent deposits for the credits which were available in 0382.

It is seen that many HOs are not using zone operations for cheque clearing. POs are directly debiting funds after cheques are cleared. Validations have been built to restrict transfer in CXFER. POs are requested to follow cheque clearing process scrupulously to ensure that sufficient funds are available in office account 0382 after regularisation of cheques. It is seen that only 3876 SOLs have credits in 0382 and 157 SOls are having credits in 0017 through zone operations for the month of January 2019.

It is suggested that the concerned HOs can lodge the cheques once again and credit 0382 account post approval of the concerned Division. These relodged cheques should not be sent to clearing house again as these cheques have already been accounted. We can allow this re-lodging till 29/01/2019. SOLs can regularise the zone and cheque amount can be utilised for deposits/account opening with the original clearing date as value date. This will also ensure that the SOLs under scenario 2 explained above, will commence zone operations and proper utilisation of 0382. Divisions to ensure that relodging is completed before 29/01/2019.

Cheques pending for account opening/subsequent deposits to be consolidated and lodged on same day after approval from Divisional head. It is responsibility of the POs to ensure that only those cheques which are cleared and accounted already but not utilised for account opening/subsequent deposits to be lodged again.

Please revert in case of any issues.

This has the approval of DDG FS sir.

Thanks and Regards...

Gopinath S

Inspector Posts

Data Migration Command Centre(CBS)

Chennai 600 002

Instructions on Marking of PPF Loan Account for Execution of Loan Interest Batch

Dear Sir/Madam,

I am directed to convey the following

I am directed to convey the following

This is regarding marking of PPF loan accounts as failed during EOY loan interest recovery batch due to difference in SOL/CIF.

a) PPF account and PPF Loan account in different CIFs and

b) PPF account and PPF Loan account in different SOLs

Solution for above 2 issues. POs are requested to

1. Merge PPF Loan accounts with PPF account CIF for scenario (a)

2. Transfer PPF loan to SOL where PPF account stands if balance is not 0.

It is also seen that some PPF Loan accounts are having zero as balance amount and hence may be closed after checking whether interest recovery has happened correctly. Interest to be collected if not recovered.

EOY loan interest recovery batch will mark these loan accounts as failed due to the difference in SOL/CIF. The list may be circulated to the concerned SOLs for immediate necessary action.

Please treat this as urgent.

[11:30 AM, 1/29/2019] SA1. ROHIT THAKARDA: After setting and installing IPPB In internet explorer 11.

Finacle open after selecting Fincore page blank (white)

Any solution.?

[11:40 AM, 1/29/2019] SA1. ROHIT THAKARDA: Any one have Service pack1 for 64bit?

[11:43 AM, 1/29/2019] +91 91642 65549: Sir kindly send any setting in for ippb login at csi domain user please?

[12:17 PM, 1/29/2019] SA1. Shashank dwivedi: Sir,

Any one have rollout 2 installation folder download path

[2:45 PM, 1/29/2019] +91 99791 10730: Finacle status?

[3:41 PM, 1/29/2019] PA1. sanjaykrmkr2: Kindly share postal order payment by cheque in pos and csi

[5:21 PM, 1/29/2019] SA2. Manimaran. A.: Brother... how to create post box data base..

now un able to book post box transaction through pos

[11:30 AM, 1/29/2019] SA1. ROHIT THAKARDA: After setting and installing IPPB In internet explorer 11.

Finacle open after selecting Fincore page blank (white)

Any solution.?

[11:40 AM, 1/29/2019] SA1. ROHIT THAKARDA: Any one have Service pack1 for 64bit?

[11:43 AM, 1/29/2019] +91 91642 65549: Sir kindly send any setting in for ippb login at csi domain user please?

[12:17 PM, 1/29/2019] SA1. Shashank dwivedi: Sir,

Any one have rollout 2 installation folder download path

[2:45 PM, 1/29/2019] +91 99791 10730: Finacle status?

[3:41 PM, 1/29/2019] PA1. sanjaykrmkr2: Kindly share postal order payment by cheque in pos and csi

[5:21 PM, 1/29/2019] SA2. Manimaran. A.: Brother... how to create post box data base..

now un able to book post box transaction through pos

Important - Streamlining Office Accounts 0382 & 0017 in DOP Finacle

Dear Sir/Madam,

Patch for nullyfying balances in 0382 will be done today by 1800 hrs.

POs were requested to open new accounts/subsequent deposits for the cheques which have been cleared and funds available in 0382. It is still seen that may POs have not cleared the pendency for the funds lying in 0382.

POs may be instructed to open accounts/subsequent deposits for the cheques cleared before 1800 hrs today itself. HOs are requested to kindly share the clearance intimation to concerned offices immediately.

Please treat this as urgent.

Thanks and Regards

Gopinath S Inspector Posts

Data Migration Command Centre(CBS)

Chennai 600 002

9962067155

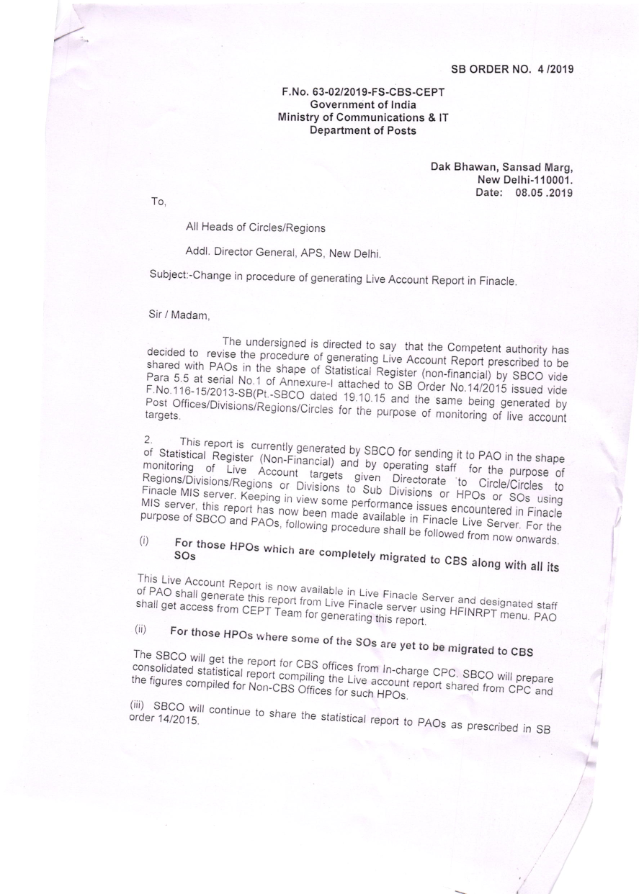

New Reports Deployed in Finacle MIS Server in HFINRPT Menu

New Reports deployed in Finacle MIS Server in HFINRPT Menu

Respected Sir/Madam,

The following are the new reports deployed in MIS server in HFINRPT Menu.This url is accessible for Supervisor, SBCO Supervisor, System Administrators, Users with auditor role (IPs,ASP, Divisional Heads).

This reports gives the list of Branch Offices along with their BO codes under the given SOL ID. SOL ID is the input criteria. Report will be generated and viewed through HPR menu . This BO code is useful in HACSP and other menus.

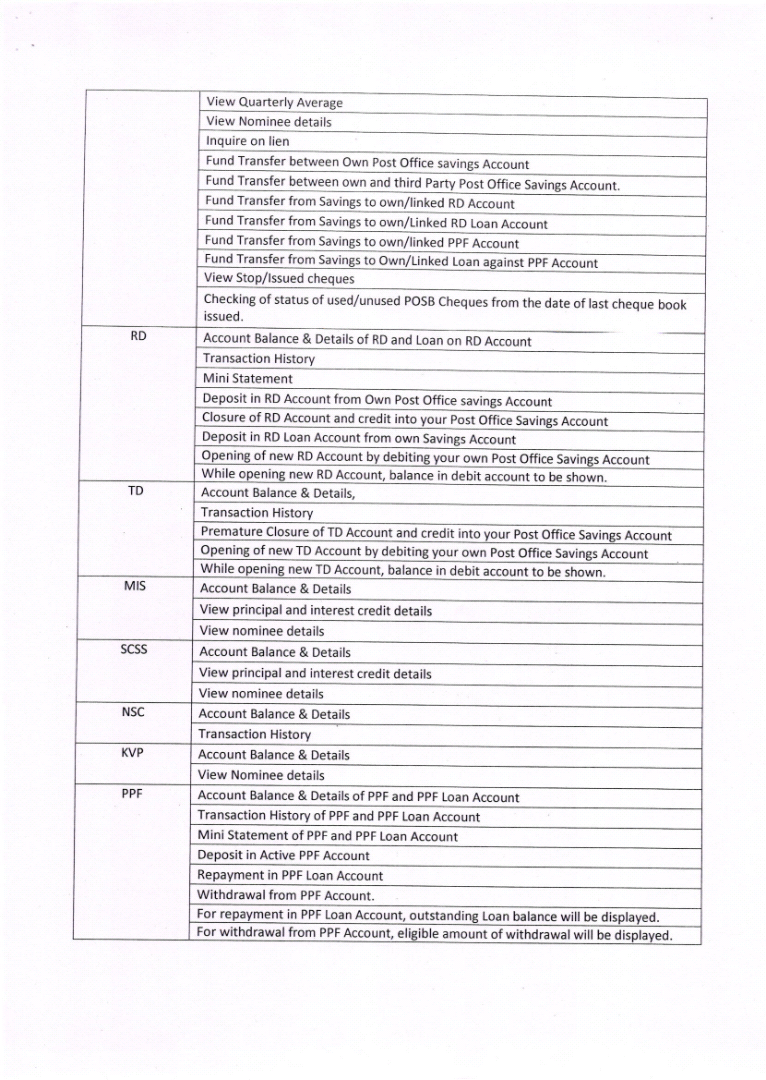

This report list the live account in SBA schemes viz SBGEN, SBBAS, SBCHQ, SSA, PPF,NSS,etc. with address, DLT and BAT. This report can be generated BO wise also if BO code is given as input criteria. The following columns are available in this report

SNo.Account NoCust NameCust CIF IDCust2 NameCust2 CIF IDCust3 NameCust3 CiF IDAddressAcct TypeBATDLTSTATUSLoan acct No.BO Name

This report will be very useful for generating Cent Per Cent verification reports, BO accounts.

Note: Please see to that no separate requests to be given to CEPT team for generating Cent Per Cent verification reports. This can be generated at PO end itself.

This report list the live account in TDA schemes viz RD,TD,NSC,KVP etc. with address, DLT and BAT. This report can be generated BO wise also if BO code is given as input criteria. The following columns are available in this report

SNo.Account NoCust NameCust CIF IDCust2 NameCust2 CIF IDCust3 NameCust3 CiF IDAddressAcct TypeBATDLTSTATUSFreezed/Disc reasonLoan acct No.BO Name

This report will be very useful for generating Cent Per Cent verification reports, BO accounts.

Note: Please see to that no separate requests to be given to CEPT team for generating Cent Per Cent verification reports. This can be generated at PO end itself.

This is for your kind information.

Thanks and Regards,

DOP Reports Team

CBS-CEPT, Chennai - 600 002

044 - 28524482(ext-212)

Finacle MIS Server Link :https://dpdcpflmis.fsi.indiapost.gov.in:1443/finbranch/ui/SSOLogin.jsp

SB Orders Compilation in Category Wise [Department of Posts]

December 22, 2018

Agents

,

CBS

,

Death Claim

,

Finacle

,

Interest Rates

,

KVP

,

MIS

,

NSC

,

PPF

,

RD

,

SB

,

SB Orders

,

SBCO

,

SCSS

,

SSA

,

TD

Post Office Saving Bank Orders Compilation - India Post

Full compilation of SB orders category wise.

Done by Shri. N. Prasanna, Villupuram HPO

Subscribe to:

Posts (Atom)

Author Name

Powered by Blogger.